November 25, 2025

Markets Face a Looming Correction

Developments of the year and a well-founded outlook: Read our experts’ analyses and forecasts on the stock markets here.

The 2026 Annual Outlook – Stocks

- Dr. Berndt Fernow · Strategy / Macro Research

After a three-year rally, global stock markets are now quite expensive. The risk premium for equities over bonds has narrowed to a minimum. The key driver of this rally has been the hype around artificial intelligence (AI). So far, the AI enthusiasm has overshadowed disruptions from the Oval Office. Investors appear to have grown complacent – after all, things have gone well so far.

But this is precisely where the danger lies for markets: ignoring risks doesn’t make them disappear. U.S. trade policy is subtly fueling inflation, keeping interest rates elevated, and slowing growth, both in the U.S. and in export- driven economies like Germany. This triple burden affects equities by cutting into corporate profits, raising financing costs, and pressuring valuations. Global supply chain disruptions also loom if China continues to use its control over strategic metals as political leverage. From an investor’s perspective, another source of concern is the unprecedented concentration of market capitalization in just a few AI-driven companies. While these firms are highly profitable, they are now committing massive investments in data centers, which will lead to significant depreciations in the coming years.

Slowing earnings momentum could put pressure on valuations of U.S. stock market leaders. For euro-based investors, currency risks should not be overlooked. The U.S. administration has stated clearly that it intends to use monetary and currency policy to its own advantage, adding another layer of uncertainty for global markets. Looking ahead, we expect a prolonged phase of risk aversion in 2026, with major indices likely to fall well below their levels at the start of the year. However, opportunities exist outside the U.S.-dominated mainstream. Asian and European stocks are significantly cheaper than their American counterparts. Meanwhile, stocks reliably paying high dividends are worth considering, as are mid-cap and second-tier equities.

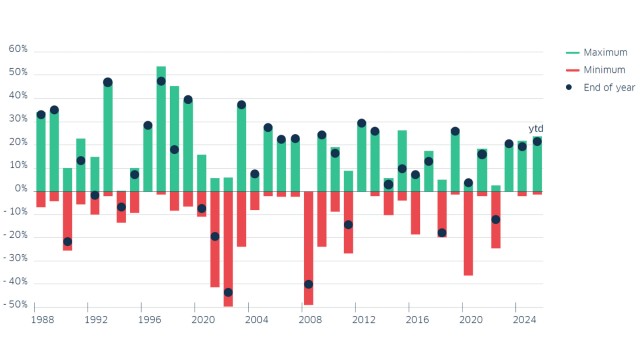

Unlike in previous years, the DAX is likely to slip temporarily into negative territory in 2026

Performance range of the DAX in each calendar year

Key questions from clients answered by our experts

Is it worth investing in U.S. value stocks?

At the U.S. stock market, the spotlight is entirely on key players of artificial intelligence. In contrast, shares of established, profitable companies with stable business models and attractive dividend policies are being overlooked. However, many global corporations fall into this category, and for us, they remain fundamental investments.

Does AI offer opportunities for new providers in Europe as well?

Ultimately, the winners are not necessarily companies that drive new technology with significant investments. Instead, it’s those that develop new business models from it. Additionally, companies that only need adapt their products, such as providers of traditional technology, also stand to benefit. Europe has many such companies, while new ideas usually achieve a breakthrough in the U.S.

Are emerging markets about to enjoy a renaissance?

Tectonic shifts in the global economy and trade outside the U.S. certainly offer opportunities for a comeback. However, we would focus on stock markets that genuinely allow participation in the growth and structural transformation of economies, particularly those with a high share of technology and services. By contrast, economies dominated by state-controlled enterprises and commodity firms are likely to disappoint.

Dr. Berndt Fernow · Strategy / Macro Research

The 2026 Annual Outlook – eight topics in focus

The 2026 annual outlook – PDF download

-

3.3 MB | 25.11.2025

This publication is addressed exclusively at recipients in the EU, Switzerland and Liechtenstein. This publication is not being distributed by LBBW to any person in the United States and LBBW does not intend to solicit any person in the United States.

LBBW is under the supervision of the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Germany) and the German Federal Financial Supervisory Authority (Ba- Fin), Graurheindorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany).

This publication is based on generally available sources which we are not able to verify but which we believe to be reliable. Nevertheless, we assume no liability for the accuracy and completeness of this publication. It conveys our non-binding opinion of the market and the products at the time of the editorial deadline, irrespective of any own holdings in these products. This publication does not replace individual advice. It serves only for informational purposes and should not be seen as an offer or request for a purchase or sale. For additional, more timely information on concrete investment options and for individual investment advice, please contact your investment advisor.

We retain the right to change the opinions expressed herein at any time and without prior notice. Moreover, we retain the right not to update this information or to stop such updates entirely without prior notice.

Past performance, simulations and forecasts shown or described in this publication do not constitute a reliable indicator of future performance.

The acceptance of provided research services by a securities services company can qualify as a benefit in supervisory law terms. In these cases LBBW assumes that the benefit is intended to improve the quality of the relevant service for the customer of the benefit recipient.

Proprietary Rights Notice: © 2014, Moody’s Analytics, Inc., its licensors and affiliates (“Moody’s”). All rights reserved. Moody’s ratings and other information (“Moody’s Information”) are proprietary to Moody’s and/or its licensors and are protected by copyright and other intellectual property laws. Moody’s Information is licensed to Distributor by Moody’s. Moody’s information may not be copied or otherwise reproduced, repackaged, further transmitted, transferred, disseminated, redistributed or resold, or stored for subsequent use for any such purpose, in whole or in part, in any form or manner or by any means whatsoever, by any person without Moody’s prior written consent. Moody’s® is a registered trademark.