November 25, 2025

Geopolitics: Power and economic structures in transition

Developments of the year and a well-founded outlook: Read our experts’ analyses and forecasts on geopolitics here.

The 2026 Annual Outlook – Geopolitics

- Sandro Pannagl and Matthias Krieger · Strategy / Macro Research

The world is changing, leading to shifts in frameworks shaping global affairs. The United States, once seen as a "benevolent hegemon" of a rules-based global order, now engages in a pure political power play. The current administration has raised the average effective tariff rate on U.S. imports from 2% to 18%. This shift is largely a response to China, which is pursuing similar goals through different means. By using export controls on rare earth elements, Xi Jinping demonstrated his power.

Europe, politically and militarily weak and lagging behind in technology, is struggling to adapt to this new environment. The EU’s actions often make it appear a helpless pawn of foreign powers. Ironically, the U.S.’s protectionist stance is more a sign of weakness. America’s share of global trade is falling (down to 13%), and despite tariffs, 70% of global trade is still conducted under WTO rules.

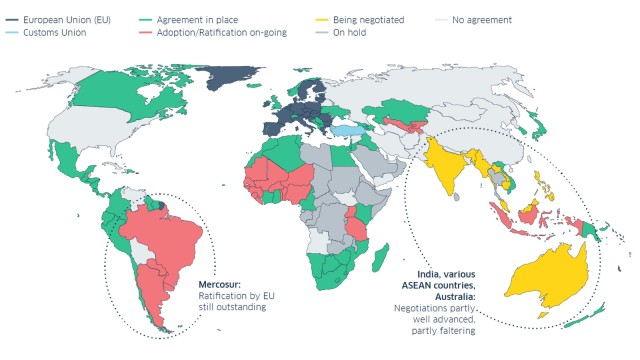

Many countries value rules-based trade and are eager to strike trade agreements with the EU and its single market of 450 million people: Mercosur, India, Indonesia, other ASEAN nations, and Australia – countries with large populations, vast reserves of strategic minerals, and high GDP growth. The EU must seize these opportunities, and would also do well to reduce internal trade barriers.

The EU is working on more trade agreements

Meanwhile, the EU-U.S. trade agreement is on shaky ground. The EU has committed to $600 billion in investments in the U.S. and $750 billion in energy imports, yet it’s unclear how these promises will be fulfilled. If these “deals” fall through, the entire agreement would be rendered meaningless.

At the same time, Russia’s aggression continues to destabilize Europe. With the U.S. no longer seen as a reliable ally, Europe must rethink and rebuild its security architecture – a Herculean task. On top of that comes the financial burden: given empty public coffers, responsibility will likely fall to Germany to establish conventional military deterrence. Whether the public will accept these burdens remains to be seen. So far, disappointing efforts to reform Germany’s social security systems and improve competitiveness paint a worrying picture for the future.

In the Middle East, a ceasefire brokered under U.S. leadership has brought temporary calm. Whether it will lead to lasting peace is doubtful. The Netanyahu government appears to view the deal as a missed opportunity to annex Gaza and the West Bank. Hamas, for its part, agreed only out of exhaustion. The conflict remains unresolved. The living conditions of Palestinians and their recent experiences fuel the potential for further violence. There is hope that Syria might now act as a stabilizing force – but even that is uncertain, as is Iran’s trajectory. The region remains a powder keg.

Relations between the West and China continue to be strained. The recent trade deal between Washington and Beijing is only a temporary truce, allowing both sides to reduce vulnerabilities. The systemic rivalry persists. Europe shares many of America’s concerns about Beijing but faces its own strategic limitations, given its reliance on China’s supply chains and consumer market. Past warning signs (i.e., forced technology transfers) were largely ignored. Meanwhile, the new five-year plan reinforces the CCP’s strategic policy approach, something often lacking in European capitals.

East Asian countries continue to seek close ties with the U.S. despite tariff conflicts, while Southeast Asia is pursuing regional integration alongside deeper cooperation with Beijing. Unless the EU initiates new bold partnerships, it risks falling further behind in these regions.

ASEAN

Japan

Korea

Key questions from clients answered by our experts

What would it cost to rebuild Ukraine?

International organizations estimate the costs at around $550 billion. The longer the war lasts, the more expansive it will become. The most severely damaged areas are the transportation and energy infrastructure, as well as housing. Ukraine will depend on international aid for the reconstruction. Even now, the estimated costs are already 2.5 times the country’s GDP.

How would an annexation of Taiwan impact the global economy?

A Chinese invasion of Taiwan would have catastrophic consequences. It would massively disrupt key shipping routes in East and Southeast Asia, and bring Taiwanese chip production to a halt. This would lead to a collapse in global supply chains. An involvement of neighboring countries cannot be ruled out. The global damage would far exceed that of the COVID crisis.

Does Europe still have enough economic power to exert influence?

Yes! Europe remains an economic heavyweight. The EU's GDP is larger than China’s, and there is no need to shy away from comparison with the US either. While there are technological deficits, the foundation is there: without machinery from Europe, there would be no high-performance chips. In the longer run, US isolationism could provide Europe with a competitive advantage. With regards to China, a clear strategy is needed.

Are the BRICS taking over the West's leadership role?

No. To assume a global leadership role, a unifying worldview as the foundation of a world order is required. However, the BRICS countries are only united in their opposition. They feel excluded by the West and believe they are not adequately represented in international institutions. Conflicting interests between key BRIC nations are too significant to formulate an alternative world order.

Sandro Pannagl and Matthias Krieger · Strategy / Macro Research

The 2026 Annual Outlook – eight topics in focus

The 2026 annual outlook – PDF download

-

3.3 MB | 25.11.2025

This publication is addressed exclusively at recipients in the EU, Switzerland and Liechtenstein. This publication is not being distributed by LBBW to any person in the United States and LBBW does not intend to solicit any person in the United States.

LBBW is under the supervision of the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Germany) and the German Federal Financial Supervisory Authority (Ba- Fin), Graurheindorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany).

This publication is based on generally available sources which we are not able to verify but which we believe to be reliable. Nevertheless, we assume no liability for the accuracy and completeness of this publication. It conveys our non-binding opinion of the market and the products at the time of the editorial deadline, irrespective of any own holdings in these products. This publication does not replace individual advice. It serves only for informational purposes and should not be seen as an offer or request for a purchase or sale. For additional, more timely information on concrete investment options and for individual investment advice, please contact your investment advisor.

We retain the right to change the opinions expressed herein at any time and without prior notice. Moreover, we retain the right not to update this information or to stop such updates entirely without prior notice.

Past performance, simulations and forecasts shown or described in this publication do not constitute a reliable indicator of future performance.

The acceptance of provided research services by a securities services company can qualify as a benefit in supervisory law terms. In these cases LBBW assumes that the benefit is intended to improve the quality of the relevant service for the customer of the benefit recipient.

Proprietary Rights Notice: © 2014, Moody’s Analytics, Inc., its licensors and affiliates (“Moody’s”). All rights reserved. Moody’s ratings and other information (“Moody’s Information”) are proprietary to Moody’s and/or its licensors and are protected by copyright and other intellectual property laws. Moody’s Information is licensed to Distributor by Moody’s. Moody’s information may not be copied or otherwise reproduced, repackaged, further transmitted, transferred, disseminated, redistributed or resold, or stored for subsequent use for any such purpose, in whole or in part, in any form or manner or by any means whatsoever, by any person without Moody’s prior written consent. Moody’s® is a registered trademark.