November 25, 2025

Yield Differentials Strengthen the Euro

Developments of the year and a well-founded outlook: Read our experts’ analyses and forecasts on currencies here.

The 2026 Annual Outlook – Currencies

- Dirk Chlench · Strategy / Macro Research

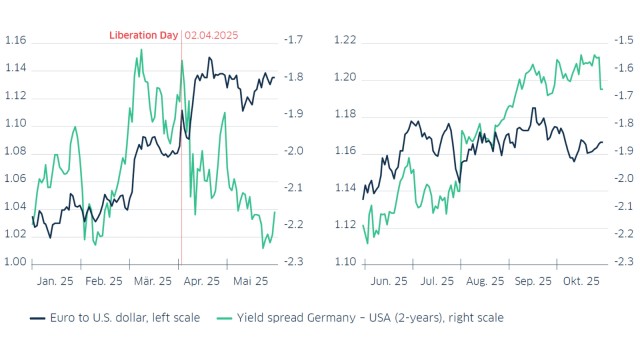

Yield differentials have always been a key factor in the exchange rate relationship between the euro and the U.S. dollar. Although the so-called “Liberation Day” in early April – when the U.S. announced sweeping tariff increases on nearly all its trading partners – temporarily disrupted this dynamic (see left chart), yield differentials have returned as a driver of exchange rate movements in recent months (see right chart) and are central to our forecast.

While the ECB’s spree of interest rate cuts has come to a halt, we expect the Federal Reserve to lower its benchmark interest rate by the end of 2026 two more times by 25 basis points, due to persistent labor market weakness. These divergent monetary policies are expected to reduce the yield advantage of short-term U.S. Treasuries compared to equivalent German Bunds.

Historically, there have been extended periods when the euro-dollar exchange rate diverged from its typical correlation with yield spreads. For instance, the joint initiative by Angela Merkel and Emmanuel Macron to establish a “Recovery Fund” in 2020 – aimed at mitigating the economic fallout of the COVID-19 pandemic – boosted the euro for many months. However, no comparable factor is currently on the horizon. While political uncertainty ahead of the French presidential elections in 2027 may put some pressure on the euro, confidence in the U.S. dollar is also being undermined by Trump’s increasingly autocratic governance. As a result, our euro- dollar forecast will continue to closely track interest rate differentials. By the end of 2026, we expect an exchange rate of $1.22 per euro.

As for the Swiss franc, the interest rate disadvantage compared to the eurozone is likely to cause a slight depreciation against the euro. Nevertheless, the potential for a significant depreciation of the franc remains limited; we do not expect the franc to reach parity with the euro in the near term.

The relationship between interest rate differentials and the U.S. dollar exchange rate broke down temporarily

Euro to U.S. dollar and yield differential

Key questions from clients answered by our experts

Can U.S. economic data still be trusted?

At the end of July, the U.S. President dismissed the head of the Bureau of Labor Statistics after the agency reported a disappointing increase in hiring. Trump accused the head of manipulating the data. However, a comparison of official statistics with the jobs increase reported by payroll service provider ADP shows no significant discrepancies compared to the past. Available data since then is not yet conclusive, but skepticism may be warranted.

Is the dollar's role as reserve currency in danger?

The current U.S. administration sees the U.S. dollar’s role as the global reserve currency more as a curse than a blessing. By attacking the Fed’s independence, it is undermining trust in the dollar itself. However, there are no clear alternatives available. So far, neither the euro nor the yuan has benefited much from this loss of trust. Gold is the winner.

Dirk Chlench · Strategy / Macro Research

The 2026 Annual Outlook – eight topics in focus

The 2026 annual outlook – PDF download

-

3.3 MB | 25.11.2025

This publication is addressed exclusively at recipients in the EU, Switzerland and Liechtenstein. This publication is not being distributed by LBBW to any person in the United States and LBBW does not intend to solicit any person in the United States.

LBBW is under the supervision of the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Germany) and the German Federal Financial Supervisory Authority (Ba- Fin), Graurheindorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany).

This publication is based on generally available sources which we are not able to verify but which we believe to be reliable. Nevertheless, we assume no liability for the accuracy and completeness of this publication. It conveys our non-binding opinion of the market and the products at the time of the editorial deadline, irrespective of any own holdings in these products. This publication does not replace individual advice. It serves only for informational purposes and should not be seen as an offer or request for a purchase or sale. For additional, more timely information on concrete investment options and for individual investment advice, please contact your investment advisor.

We retain the right to change the opinions expressed herein at any time and without prior notice. Moreover, we retain the right not to update this information or to stop such updates entirely without prior notice.

Past performance, simulations and forecasts shown or described in this publication do not constitute a reliable indicator of future performance.

The acceptance of provided research services by a securities services company can qualify as a benefit in supervisory law terms. In these cases LBBW assumes that the benefit is intended to improve the quality of the relevant service for the customer of the benefit recipient.

Proprietary Rights Notice: © 2014, Moody’s Analytics, Inc., its licensors and affiliates (“Moody’s”). All rights reserved. Moody’s ratings and other information (“Moody’s Information”) are proprietary to Moody’s and/or its licensors and are protected by copyright and other intellectual property laws. Moody’s Information is licensed to Distributor by Moody’s. Moody’s information may not be copied or otherwise reproduced, repackaged, further transmitted, transferred, disseminated, redistributed or resold, or stored for subsequent use for any such purpose, in whole or in part, in any form or manner or by any means whatsoever, by any person without Moody’s prior written consent. Moody’s® is a registered trademark.