November 25, 2025

Setting Off with Uncertainties

Developments of the year and a well-founded outlook: Read our experts’ analyses and forecasts on economy here.

The 2026 Annual Outlook – Economy

- Dr. Jens-Oliver Niklasch · Strategy / Macro Research

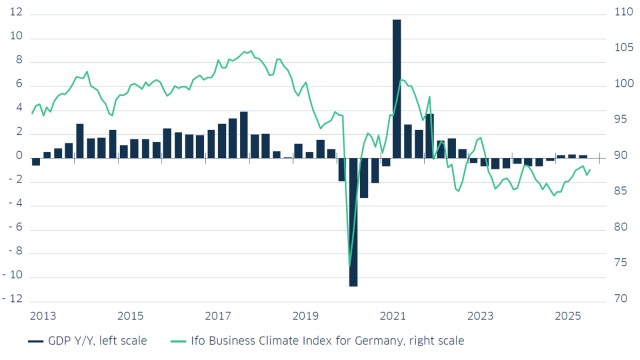

Three years of stagnation are now behind Germany. In 2025, real GDP was roughly at the same level as in 2019. However, growth may at last pick up next year. There are reasons for optimism: since 2003, the ECB has halved its key interest rates to 2%, which should have a positive effect on economic activity. For the optimists, the trump card is fiscal policy. The deficit ratio stood at 2.8% of GDP in 2024. According to Bundesbank estimates, it could temporarily decline in 2025, only to rise to 4% in the following two years. The federal government is accumulating debt, both in the core budget and through special funds, to increase defense and investment spending. We expect this stimulus to boost economic output by 0.8% next year. This effect could be even greater were it not for the fact that some of the special funds support consumption rather than investments, and that the core budget increasingly reflects a system in which regular capex expenditures are reallocated to special funds, undermining their original purpose of funding additional investments. An additional calendar effect (from the timing of holidays) is expected to push GDP up by nearly 0.3 percentage points.

The risks for 2026, on the other hand, are all too familiar: U.S. trade policy has disrupted Germany's trade engine by increasing import tariffs. Exports to the U.S., hitherto Germany’s most important export destination, are now declining. Further measures are also conceivable. Since the start of his second term, U.S. President Donald Trump has displayed a strong interventionist tendency, with no signs of letting up. Also high on the risk list: There are still no signs of an end to the war in Ukraine.

Inflation, however, seems to be under control. At just over 2%, it is hovering near the ECB’s target. This is likely to support real incomes and household consumption. Price levels in upstream stages are also largely stable. The labor market, however, still bears the scars of recent lean years. Unemployment is edging upwards towards the three-million mark, with no reversal in sight.

Germany has been in stagnation for three years

Ifo Business Climate and GDP year-on-year comparison

Key questions from clients answered by our experts

Will CO2-prices mean higher inflation?

Currently, the CO2 price for fuels is set at €55 per ton. In 2026, the allowed trading range will be €55-65, before market pricing begins in 2027. As a result, fuel prices could increase by up to 10% in 2026. If the increase is fully passed on to household energy costs, inflation could temporarily rise by up to one per cent.

Is a new debt crisis looming in the Eurozone?

The budget deficit of France is too high, but not as excessive as in Greece back then (10% to 15% from 2008-2011). Moreover, with the European Stability Mechanism (ESM) and potential ECB bond purchases, the EU’s institutions are better equipped to handle a debt crisis nowadays. Nevertheless, France needs to consolidate its finances to avoid losing the market’s trust.

Dr. Jens-Oliver Niklasch · Strategy / Macro Research

The 2026 Annual Outlook – eight topics in focus

The 2026 annual outlook – PDF download

-

3.3 MB | 25.11.2025

This publication is addressed exclusively at recipients in the EU, Switzerland and Liechtenstein. This publication is not being distributed by LBBW to any person in the United States and LBBW does not intend to solicit any person in the United States.

LBBW is under the supervision of the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Germany) and the German Federal Financial Supervisory Authority (Ba- Fin), Graurheindorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany).

This publication is based on generally available sources which we are not able to verify but which we believe to be reliable. Nevertheless, we assume no liability for the accuracy and completeness of this publication. It conveys our non-binding opinion of the market and the products at the time of the editorial deadline, irrespective of any own holdings in these products. This publication does not replace individual advice. It serves only for informational purposes and should not be seen as an offer or request for a purchase or sale. For additional, more timely information on concrete investment options and for individual investment advice, please contact your investment advisor.

We retain the right to change the opinions expressed herein at any time and without prior notice. Moreover, we retain the right not to update this information or to stop such updates entirely without prior notice.

Past performance, simulations and forecasts shown or described in this publication do not constitute a reliable indicator of future performance.

The acceptance of provided research services by a securities services company can qualify as a benefit in supervisory law terms. In these cases LBBW assumes that the benefit is intended to improve the quality of the relevant service for the customer of the benefit recipient.

Proprietary Rights Notice: © 2014, Moody’s Analytics, Inc., its licensors and affiliates (“Moody’s”). All rights reserved. Moody’s ratings and other information (“Moody’s Information”) are proprietary to Moody’s and/or its licensors and are protected by copyright and other intellectual property laws. Moody’s Information is licensed to Distributor by Moody’s. Moody’s information may not be copied or otherwise reproduced, repackaged, further transmitted, transferred, disseminated, redistributed or resold, or stored for subsequent use for any such purpose, in whole or in part, in any form or manner or by any means whatsoever, by any person without Moody’s prior written consent. Moody’s® is a registered trademark.