November 25, 2025

Heading in the Right Direction

Developments of the year and a well-founded outlook: Read our experts’ analyses and forecasts on real estate here.

The 2026 Annual Outlook – Real Estate

- Benedikt Horwedel · Strategy / Macro Research

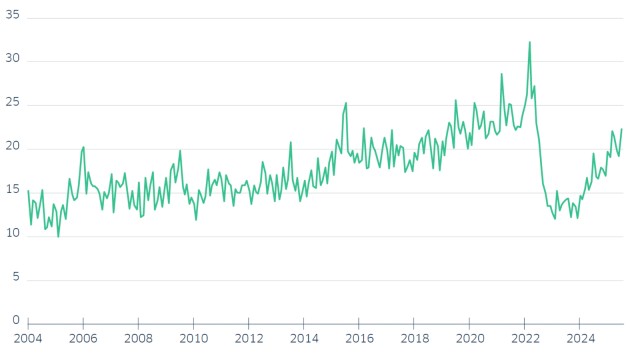

The prices for residential real estate in Germany are picking up again. Nevertheless, it will take some time before the pre-Covid level is reached. Reasons for this include stagnant population growth and only slowly increasing rents. For 2026, we expect an average price increase of 3% to 4%. One driving factor is the reawakened interest of private households: in the first half of 2025, new mortgage loans were around one-third higher compared to the previous year. The third quarter also showed robust loan demand. For 2026, we expect this encouraging development to continue, albeit at a slightly reduced pace. A swift return to the boom times of the low-interest phase seems unlikely.

An additional boost is currently being experienced in private residential construction projects – not least due to the broadening realization that interest rates are unlikely to decline further in the foreseeable future. We also expect that mortgage interest rates will tend to rise, as they are influenced, among other factors, by the yield levels of German government bonds, which we expect to inch upwards. However, residential real estate is unlikely to regain its former glory anytime soon, as the market continues to be weighed down by weak economic conditions and higher unemployment. How strong the impact of the government's "building turbo" initiative will be remains to be seen. Much depends on how quickly municipalities use the new flexibility and accelerate their approval processes. Overall, the outlook is cautiously positive.

Residential real estate also remains in demand in the commercial real estate market. In the first half of the year, it was the asset class with the highest transaction volume. Investment volumes are picking up again but remain significantly below the long-term average. Office properties, however, remain challenging, particularly in less desirable locations. Transaction volumes remain some 80% below the level that had prevailed when the ECB started hiking rates in 2022. The trend toward higher vacancy rates is likely to continue, as more people retire and hybrid work models remain popular. While new lease rents in the office segment are rising, this is primarily due to individual high-end transactions. Overall, we do not expect significant jumps in transaction volumes in 2026.

Recovery in the private residential real estate market

New private residential mortgage originations in € billion, monthly

Key questions from clients answered by our experts

Do investments in real estate currently make sense?

Germany is still facing a shortage of housing. Hence, rents and prices for residential properties are on the rise again. No one should expect to get rich overnight with real estate. However, a house or apartment can serve as a safeguard against surging rents. In short, those who can manage to finance a residential property and invest are unlikely to regret it in the long run.

Would it be better to obtain long-term or short-term financing for a real estate loan?

Currently, short-term interest rates are once again lower than those of long-term loans. However, the ECB demonstrated in 2022 how quickly it can raise money market rates. Geopolitical tensions also argue in favor of long-term fixed interest rates. In light of the experiences of recent decades, we would prioritize long-term planning security over potential shortterm benefits.

Benedikt Horwedel · Strategy / Macro Research

The 2026 Annual Outlook – eight topics in focus

The 2026 annual outlook – PDF download

-

3.3 MB | 25.11.2025

This publication is addressed exclusively at recipients in the EU, Switzerland and Liechtenstein. This publication is not being distributed by LBBW to any person in the United States and LBBW does not intend to solicit any person in the United States.

LBBW is under the supervision of the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Germany) and the German Federal Financial Supervisory Authority (Ba- Fin), Graurheindorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany).

This publication is based on generally available sources which we are not able to verify but which we believe to be reliable. Nevertheless, we assume no liability for the accuracy and completeness of this publication. It conveys our non-binding opinion of the market and the products at the time of the editorial deadline, irrespective of any own holdings in these products. This publication does not replace individual advice. It serves only for informational purposes and should not be seen as an offer or request for a purchase or sale. For additional, more timely information on concrete investment options and for individual investment advice, please contact your investment advisor.

We retain the right to change the opinions expressed herein at any time and without prior notice. Moreover, we retain the right not to update this information or to stop such updates entirely without prior notice.

Past performance, simulations and forecasts shown or described in this publication do not constitute a reliable indicator of future performance.

The acceptance of provided research services by a securities services company can qualify as a benefit in supervisory law terms. In these cases LBBW assumes that the benefit is intended to improve the quality of the relevant service for the customer of the benefit recipient.

Proprietary Rights Notice: © 2014, Moody’s Analytics, Inc., its licensors and affiliates (“Moody’s”). All rights reserved. Moody’s ratings and other information (“Moody’s Information”) are proprietary to Moody’s and/or its licensors and are protected by copyright and other intellectual property laws. Moody’s Information is licensed to Distributor by Moody’s. Moody’s information may not be copied or otherwise reproduced, repackaged, further transmitted, transferred, disseminated, redistributed or resold, or stored for subsequent use for any such purpose, in whole or in part, in any form or manner or by any means whatsoever, by any person without Moody’s prior written consent. Moody’s® is a registered trademark.