New guarantee structure expands balance sheet possibilities - LBBW generates new portfolio of EUR 350 Million for wind parks and solar plants

The European Investment Bank (EIB) Group is providing a €175 million guarantee to support LBBW’s lending in the renewable energy sector. The synthetic securitisation transaction will free up capital that will then be used to channel €350 million in new financing from LBBW for clean power projects, thus contributing to the decarbonisation of the German economy and to Europe’s energy independence. This is one of the first transactions of its kind in Germany.

The underlying reference portfolio amounts to €3.2 billion and consists of loans to small and medium-sized companies and other corporates originated by LBBW in its ordinary business. Guaranteeing this existing portfolio will provide capital relief for LBBW, freeing up additional lending capacity. The transaction is structured with a two-year replenishment period and falls under the simple, transparent, and standardised (STS) securitisation framework approved by the European Parliament.

Through a retrocession agreement, LBBW undertakes to convert this additional lending capacity into a new portfolio that is at least double the size of the mezzanine tranche guaranteed by the EIB, or €350 million. Renewable energy projects like wind farms and photovoltaic plants often have a maturity of 20 years or more. By generating a new portfolio fully dedicated to climate action and energy security-eligible financing backed by capital that is released on a standard corporate loan portfolio, this green securitisation shows how the use of proceeds concept can be applied to securitisation.

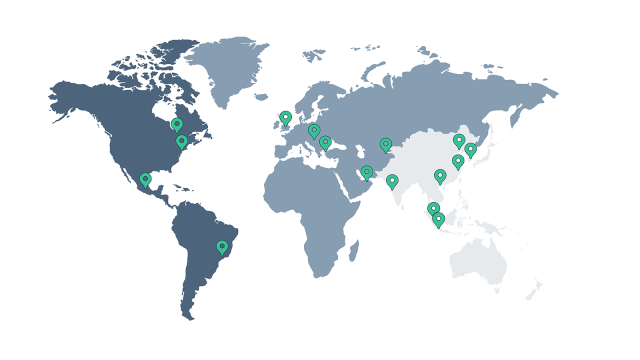

The amount allocated under this operation is expected to result in the development of about 340 MW of new electricity generation capacity from renewable sources, equivalent to the energy use of more than 1 million homes. The beneficiary companies will be in Germany, other EU Member States and Switzerland. The operation is fully in line with the EIB Group’s commitment to support the REPowerEU programme.

The EIB Group consists of the EIB and the European Investment Fund (EIF), which provides smaller companies with financing under favourable conditions. The new guarantee will be provided by the EIF to LBBW. A (back-to-back) counter guarantee from the EIB will fully mirror the EIF’s obligation, so that the EIB takes on the mezzanine tranche risk.

EIB Vice-President Ambroise Fayolle, who is responsible for operations in Germany, said: “Transactions like this one with LBBW support the decarbonisation of the energy sector and help the green transition to become a reality. I am glad that we can rely on LBBW as a trusted partner to provide the financial means needed by businesses in Germany in these challenging times.”

EIF Chief Executive Marjut Falkstedt added: “The EIF is pleased to be working with LBBW and the EIB to provide additional access to finance for renewable energy projects. The combination of the EIF’s investment and structuring expertise and the EIB’s efficient deployment of its own funds offers a competitive financing solution for LBBW that will serve to boost the green transition.”

Member of the Executive Management Board of LBBW Dr Christian Ricken said: “LBBW sees itself as a shaper of transformation. We want to support and advance the sustainable transformation of our economy. Synthetic securitisations are an excellent instrument to decisively expand the possibilities of our balance sheet for this purpose. We will now use the scope to significantly expand our activities in renewable energies.”

Your point of contact

Do you have questions?

Tobias Schwerdtfeger