LBBW confirms its preliminary results for 2013: net consolidated profit before tax of EUR 471 million substantially higher than in the previous year (EUR 399 million

LBBW confirms its preliminary results for 2013: net consolidated profit before tax of EUR 471 million substantially higher than in the previous year (EUR 399 million) Restructuring successfully completed Efforts to reduce total assets and risk weighted assets systematically continued, further significant increase in equity ratios Board of Managing Directors proposing a dividend of EUR 72 million Repayment of EUR one billion of silent partnership contributions to the owners as announced Muted start to 2014

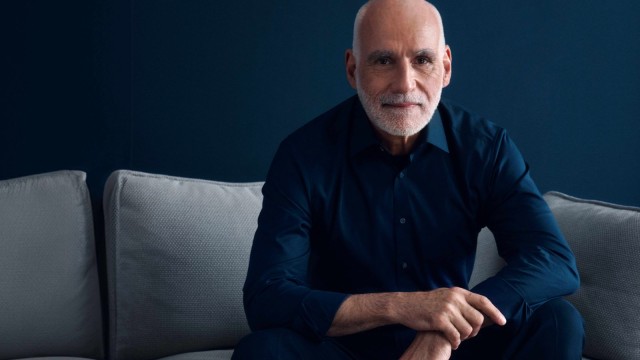

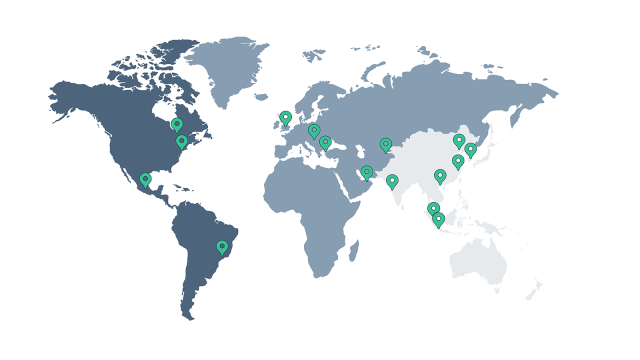

"Following the successful completion of the restructuring activities initiated in 2009, Landesbank Baden-Württemberg (LBBW) with its customer-driven business model is well poised in strategic terms to face the upcoming challenges in the banking industry," Hans-Jörg Vetter, the Chairman of LBBW's Board of Managing Directors, stressed at the financial statement press conference in Stuttgart. "Last year, we again increased our net profit before tax and appreciably improved our risk profile. At the same time we successfully completed the extensive restructuring, thus realigning the Bank," Vetter continued. "Today, LBBW is a solid and well capitalized bank. Consequently, we are well prepared for the current asset quality review and the ensuing stress test and are able to concentrate entirely on our customer business." As indicated by the preliminary figures announced in February, net profit before tax (in accordance with IFRS) rose by 18.0 percent to EUR 471 million in the 2013 financial year (previous year: EUR 399 million). "Given the reduction in legacy assets, the persistently low interest rates and the steadily mounting regulatory requirements we are, on the whole, satisfied with this result," said Vetter. The operating result climbed to EUR 726 million (previous year: EUR 694 million). The fact that the Bank has been operating profitably for eight consecutive quarters also demonstrates that it has a stable business model once again. Omitted distributions on hybrid capital to be repaid – dividend of EUR 72 million planned Moreover on the basis of the individual financial statements based on German Commercial Code (HGB), LBBW will be able to service the current distribution on silent partnership contributions and profit-participation certificates as well as repaying the distributions omitted between 2009 and 2011 in full. An amount of EUR 239 million is still outstanding in the 2013 financial year following a partial recovery in 2012. In addition, the Board of Managing Directors will be proposing the shareholders to approve a dividend of EUR 72 million at the annual general meeting. This equals the unappropriated profit calculated according to HGB. Moreover, LBBW will repay silent partnership contributions of EUR 1 billion to its owners this year. "We attach particular importance to justifying in this way the confidence that our owners have shown in us over the past few years," explained Vetter. Reduction of risk weighted assets systematically continued capital base significantly reinforced again Last year, LBBW again systematically ran off risks and took measures to sustainably reinforce its capital base. Credit substitute business, which no longer forms part of the Bank's core activities, was cut by half once again from EUR 22 billion to EUR 11 billion at the end of the year. This means that LBBW has reduced its credit substitute business, which had had a volume of EUR 95 billion at the beginning of restructuring, by almost 90 percent within a few years. There was also a further overall decrease in risk weighted assets, which declined to EUR 79 billion (31 December 2012: EUR 96 billion) on the basis of the regulatory law in force until the end of 2013 (Basel 2.5). At the end of 2008, risk weighted assets had been valued at EUR 178 billion. At the same time, LBBW was able to raise its core capital ratio (Basel 2.5) to 18.5 percent at the end of 2013, with the total ratio in accordance with SolvV coming to 22.5%. Under the new Basel III capital requirements, which took effect on 1 January 2014 - subject to the transitional rules currently applicable - the common equity Tier 1 ratio (as at 31 December 2013) stands at 13.1 percent and the total ratio in accordance with SolvV at 18.8 percent. On the basis of fully loaded Basel III, which takes effect in 2019 after the expiry of the transitional period, the common equity Tier 1 ratio equals 12.6 percent and the total ratio in accordance with SolvV 18.7 percent (both figures as at 31 December 2013). Overview of the operating segments Last year's result was underpinned by solid customer business, which is spread across the three operating segments - Corporates, Retail/Savings Banks and Financial Markets. The Corporates segment, which includes business with corporate customers and commercial real estate financing, again made the greatest contribution to net consolidated profit. The segment's net profit before tax came to EUR 722 million. Although this fell short of the previous year's very good result of EUR 913 million, the Bank is still satisfied with this result given the difficult market conditions. In addition to lower proceeds from the sale of equity investments, fairly muted credit demand in the corporate sector and the deliberate reduction in large-scale exposures, this decline compared with the previous year was particularly due to the allowances for losses on loans and advances, which more than doubled to a still moderate overall figure of around EUR 300 million. Net profit in the Retail/Savings Banks segment rose slightly over the previous year (EUR 98 million) to EUR 100 million. Spurred by stronger customer demand, securities business and asset management performed particularly well. Despite the decline in interest rates, deposit-taking business remained stable compared with the previous year. At EUR 322 million, net profit before tax in the Financial Markets segment was significantly higher than in the previous year (EUR 278 million). Operating business developed fairly, among others by buoyant customer demand for money-market products, promissory note loans and certificates. Income and balance sheet figures for 2013 At EUR 1.794 billion, net interest income was down EUR 263 million on the previous year. This decline was due to the systematically continued reduction of risk weighted assets, persistently low interest rates and muted credit demand. However, the previous year's net interest income had been inflated by a positive on-off effect of EUR 187 million. Allowances for losses on loans and advances climbed to EUR 310 million (previous year: EUR 143 million) but remained at a moderate level and substantially lower than the long-term average. Net fee and commission income rose by EUR 8 million to EUR 522 million. Improvements were primarily evident in custodian and securities business. Net gains from financial assets measured at fair value through profit or loss , which had come under pressure in the previous year from various valuation adjustments, rose to EUR 373 million. Among other things, this reflects the favorable performance of customer-related capital market business. Moreover, fair value gains in the wake of thightening spreads on credit derivatives left favorable traces on this figure. Net gains from financial instruments fell to EUR 16 million (previous year: EUR 135 million). This was chiefly due to the further systematic reduction in volumes and risks in credit substitute business. In this connection, losses were deliberately accepted in some cases. Moreover, the contributions to earnings from the sale of equity investments and investments accounted for using the equity method were well down on the previous year in 2013. Other operating income/expenses improved to EUR 105 million over the previous year due to numerous individual factors. Among other things, the contributions made by successfully completed development projects in the real estate segment had a positive effect. Administrative expenses declined by EUR 86 million to EUR 1.774 billion in the wake of the successful restructuring. Despite continued high expenses to meet regulatory requirements, there was a further reduction in staff and material costs thanks to consequent cost management. Administrative expenses also include the bank levy of EUR 67 million. The cost/income ratio improved significantly to 63.5 percent (previous year 72.6 percent). The operating result amounted to EUR 726 million, up from EUR 694 million in the previous year. The cost of the risk shield provided by the State of Baden-Württemberg came to a total of EUR 325 million, of which EUR 300 million was recognized as guarantee commission for the risk shield and the rest as net interest expense. Net income from restructuring of EUR 48 million was chiefly due to the reversal of provisions no longer required for restructuring activities. Net consolidated profit before tax rose to EUR 471 million. After tax expense , which returned to normal levels following the previous year's positive tax effects, net consolidated profit came to EUR 337 million. As planned, there was a further drop in total assets , which declined substantially by EUR 63 billion in the course of 2013 to EUR 274 billion. LBBW made use of the favorable market conditions to intensify the reduction of risks. At the end of 2008, total assets had been valued at EUR 448 billion. Strategic outlook: Strict concentration on customer business and core business segments The strict orientation to customer business has formed a key element in the restructuring efforts of the past few years. At the financial statement press conference, Hans-Jörg Vetter, the Chairman of LBBW's Board of Managing Directors, stressed that there would be no changes to this strategic orientation. The Bank will be systematically focusing on its five core business segments: corporate customers, retail customers, savings banks, commercial real estate financing and customer-oriented capital markets business. In corporate business, cross-selling is to be stepped up with the heightened sale and distribution of non-credit products, such as interest and currency hedges, payment services and support to companies in their foreign activities. Target key-account customers include companies from all across Germany as well as Austria and Switzerland. The Bank's customer-driven capital markets business is also focusing on the German-speaking regions. Commercial real estate financing chiefly comprises activities in Germany as well as selected markets in the United States and the United Kingdom. With respect to retail business, Vetter expressly confirmed the Bank's commitment to a broad-based physical presence. BW-Bank exercises the function of a savings bank in Stuttgart and maintains a network of some 180 branches across Baden-Württemberg. "As a customer-driven bank with regional roots, we aim to grow in retail customer business. For us, retail customer business is inseparable from our branch network. Despite using other channels such as Internet banking, the vast majority of our customers does not want to renounce the branches," said Vetter. At the same time, the wealth management segment, which is targeted at high net-worth customers, entrepreneurs, foundations and family offices has been growing successfully. A further key area of activity for the Bank is business with the savings banks. As the central institution for the savings banks in Baden-Württemberg, Rhineland-Palatinate and Saxony, LBBW supports the savings banks and their customers with numerous products and services. In addition, it is expanding its partnership with savings banks throughout Germany via products offering added value across the network. Outlook for the current year Economic conditions for banks will remain challenging in 2014. Although the Bank assumes that the economy will recover, leaving positive traces on the core markets of LBBW, interest rates are likely to remain at a low level. The regulatory requirements are still demanding. Against this backdrop, LBBW considers itself well-positioned with its customer-driven business model and solid capital resources. The start to 2014 was characterized by muted operating customer business. As a whole, the Bank expects to achieve a clearly positive result in the current year. At this stage, profit before tax at the same level as in the previous year is conceivable in the absence of any unforeseen market turbulence or an unexpectedly sharp decline in the economy. Business figures for the LBBW Group as at 31 December 2013 in accordance with IFRS