LBBW and Natixis Corporate & Investment Banking, a subsidiary of Groupe BPCE, the second-largest banking group in France, have signed a cooperation agreement aimed at generating joint M&A advisory mandates for the companies’ clients.

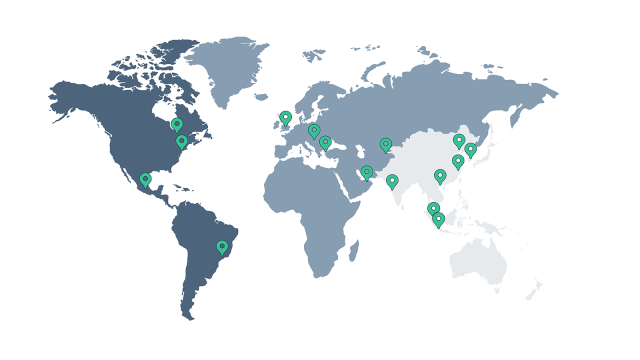

The agreement, which is non-exclusive and includes no equity investments between the signatories, is designed to combine the unique strengths of each company - LBBW with its extensive relationships with German corporates, and Natixis Corporate & Investment Banking with its global network of M&A boutiques – enhancing their capacity to propose a geographically diverse range of potential M&A mandates to their clients.

Natixis Corporate & Investment Banking’s global M&A network spanning Europe, the US and Asia Pacific has been built over the past six years through strategic investments in seven M&A boutiques. With close to 400 M&A professionals, this unique model has underpinned multiple cross-border deals between the members of the network for the benefit of clients.

At LBBW, the M&A business is one of the strategic growth areas. The M&A team is characterized by its close integration into the Corporate Finance unit, which enables holistic strategic advice - for example, through the additional involvement of sector experts for LBBW's focus industries. At LBBW, M&A is an integral part of Corporate Finance Advisory, which has around 30 employees.

Nicolas Namias, Natixis CEO said: “Natixis Corporate & Investment Banking’s M&A model is founded on two principles: expertise, which is the basis of all we do; and cooperation, for the benefit of all parties and of our clients. Our agreement with LBBW is fully aligned with these principles and will allow us to originate new transactions for our clients and continue to develop our M&A business as we implement our strategic plan, BPCE 2024.”

Karl Manfred Lochner, Member of the Board of Directors and responsible for LBBW’s Corporate Banking commented: “We are glad to cooperate with the Natixis Corporate & Investment Banking’s global M&A organization which is an impressive transaction powerhouse. Following the launch of our own M&A office in our Singapore branch, this agreement marks a further step in the internationalization of our activities - particularly beyond the regions in which we ourselves have a presence through branches and representative offices.”