Landesbank Baden-Württemberg (LBBW) yesterday issued its first own green bond. "Sustainability is a key aspect for LBBW and firmly anchored in our business strategy. This explains why the sustainable investments segment of the market plays a major role for us", explains Dr Christian Ricken, member of LBBW's Board of Managing Directors with responsibility for the capital markets. The issue has a volume of EUR 750 million and a four-year term. The Bank will be using the issuing proceeds to fund energy-efficient commercial real estate that meets national regulations or internationally recognized standards as well as renewable energy projects going forward.

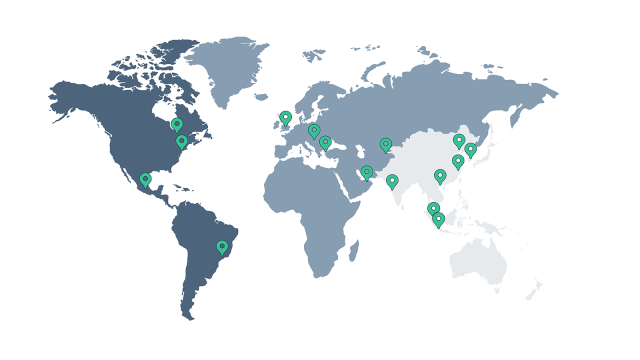

After placing "green" issues for its clients LBBW now issues its first own green bond The largest green bond issue by a European commercial bank to date - issuance volume: EUR 750 million, term: four years LBBW makes a substantial contribution to market performance and thus helps decarbonize the commercial real estate sector Framework for further issues defined · Transaction size underscores the great importance LBBW attaches to sustainability LBBW commissioned real estate expert Drees & Sommer to develop a simple methodology for the selection of "green assets" on the basis of official data from the German Energy Agency (dena) and the German Energy Saving Ordinance (EnEV). This methodology can also be used by other market participants. In this way LBBW is making a substantial contribution to developing the green bond market and also helping to decarbonize the commercial real estate sector in Germany. With its first own green bond LBBW is continuing the series of successful "green" issues "The successful placement of our first own green bond is further proof of LBBW's good standing on the international bond market", explains Dr Ingo Hansen, Head of Treasury at LBBW. The senior unsecured benchmark bond has an issuance volume of EUR 750 million and a four-year term (until 13 December 2021). It was placed on the market by a syndicate consisting of ABN, Crédit Agricole, ING, Société Générale and LBBW. The transaction was substantially oversubscribed very quickly with an order volume of around EUR 1.4 billion. The very well-diversified order book includes more than 80 domestic and international investors. A good one quarter of the orders came from foreign investors. The Bank has already assisted its customers with numerous green issues in the past. In Germany the Bank's market share of green bond issues is just under 40 percent. This year LBBW took a leading role in the first green benchmark bond of a German corporate (innogy) and in the first green Schuldscheindarlehen in the automotive sector (Mann+Hummel). Market for "green" bonds remains notably on the rise "The market for sustainable investments will continue its strong growth. We are very well-positioned to participate in this trend", explains Ricken. In the course of preparing for the green bond LBBW drew up an extensive framework for the issue of this and other green bonds. "We have thus built up additional know-how and laid the foundations for further issues of our own on the primary market for sustainable investments", adds Ricken.