- Earnings increases due to growth in customer business and cost reduction

- Business with corporate and real estate customers profitably expanded – Loan and deposit volumes also up in retail banking

- Cost/income ratio improves significantly to 71.7%

- Higher allowances for losses on loans and securities – with very good portfolio quality and consistently low NPL ratio of 0.6%

- Common equity Tier 1 capital ratio at 14.6% and therefore clearly above regulatory requirements

- Volume of sustainable investments rises to approximately EUR 23 billion

- Profit before tax for 2019 as a whole expected in the mid three-digit EUR million range and above the prior-year level

LBBW continued its profitable growth in the first half of 2019 and increased its profit before tax by 12.9% to EUR 319 million. The cost/income ratio declined by 3.7 percentage points as against 30 June 2018 to 71.7%. The return on equity improved to 5.0%.

“We have not only done more business with our customers, but we are also working more profitably. We can be highly satisfied with LBBW’s performance in the first half of the year,” said Rainer Neske, Chairman of LBBW’s Board of Managing Directors. “Our strategy, which we have been implementing for two and a half years, is paying off in terms of income and costs.”

This progress is taking place in a challenging environment of persistently low interest rates, fierce competition, high volatility on the capital market and sustained regulatory pressure. Despite an increase in allowances for losses on loans and securities against the backdrop of the incipient economic slowdown in Germany, the Bank also still has excellent portfolio quality. The non-performing loan (NPL) ratio is unchanged at just 0.6%. LBBW’s capitalization also remains solid. Although risk weighted assets have risen to EUR 82 billion as a result of the growth in customer business, the common equity Tier 1 capital ratio remained at 14.6% – clearly above the regulatory capital requirements (CRR/CRD IV fully loaded). At 21.9%, the total capital ratio is still clearly above the 20% mark.

In the first half of 2019, LBBW systematically continued to develop its business model as a Mittelstand-minded universal bank in line with its strategic agenda with the cornerstones of business focus, digitalization, sustainability and agility.

Business focus drives growth

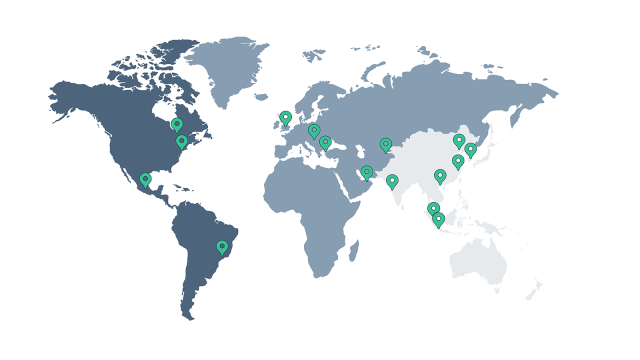

This can also be seen in the more extensive financing volume with midsized and large corporate customers in the past twelve months, which has grown by around 10% in total to EUR 51 billion. In this area LBBW is increasingly experiencing growth in the new focus sectors utilities and energy, pharmaceutical and healthcare as well as telecommunicationmedia- technology (TMT). Real Estate/Project Finance grew its portfolio, thanks in part to prestigious projects such as the ‘Quartier Heidestrasse’ near Berlin Hauptstadtbahnhof. Loan and deposit volumes were also on the rise once more in retail banking. In Capital Markets Business, LBBW again confirmed its leading position in placing covered bonds under tough market conditions.

Pioneering work in green Pfandbriefe and loans

LBBW also raised its profile as a sustainable bank. In May it placed an innovation on the green capital market: the first green USD Hypothekenpfandbrief (USD 750 million). Also in May LBBW issued its first own unsecured green senior non-preferred bond (EUR 750 million), followed in July by a further green senior non-preferred bond of EUR 500 million. In terms of financing, LBBW did pioneering work with the positive incentive loan for the tech company Voith and a positive incentive Schuldschein for the equipment manufacturer Dürr. Just recently, LBBW accompanied the largest green Schuldschein to date (EUR 1 billion) for the car manufacturer Porsche. The volume of sustainable investments for customers climbed to almost EUR 23 billion in the first half of the year. LBBW’s strong commitment to sustainability is also being recognized by experts: The sustainability rating agencies ISS-oekom, Sustainalytics, imug and MSCI ESG Research have given the Bank good grades in their latest reports.

Digitalization initiatives making good progress

LBBW’s digitalization initiatives continued to make progress in the first half of the year, for instance in Schuldschein business, in securitization and in trade finance: The Debtvision Schuldschein platform launched a year ago has now digitally marketed more than 30 transactions and has more than 200 registered investors. Trading transactions were handled on a blockchain basis for the first time using the Marco Polo trade finance network. The distributed ledger technology was also successfully used for the first time for the purchase and repayment of an asset-backed commercial paper on the Weinberg securitization platform.

Figures at a glance

Net interest income was up EUR 15 million year-on-year at EUR 811 million in the first half of the year. This is primary due to brisk business with mid-sized and large corporate customers and in real estate financing. Net fee and commission income increased by EUR 17 million to EUR 279 million, partly as a result of higher financing commission and an increase in income from bond and Schuldschein issues. Closer cooperation between Corporate Customers and Capital Markets Business paid off here.

Net gains on remeasurement and disposal improved to EUR 144 million, EUR 9 million more than the prior-year figure. Among other things, this was driven by higher contributions from sales of secureties in LCR portfolio management. In contrast, allowances for losses on loans and securities rose by EUR 30 million to EUR 63 million against the backdrop of the incipient economic slowdown.

The concerted efforts to cut costs are gradually paying off and led to a reduction in administrative expenses of EUR 14 million to EUR 864 million in the first half of the year. However, expenses for the bank levy and deposit guarantee system rose by EUR 13 million to EUR 102 million, primarily due to transfers to the guarantee system of Sparkassen-Finanzgruppe in connection with the support for NordLB and an increase in the bank levy caused by a revised allocation basis.

In total, the consolidated profit before tax was EUR 319 million and therefore EUR 36 million higher than in the same period of the previous year. Despite an increased income tax expense, net consolidated profit was also up year-on-year at EUR 219 million (EUR 206 million).

Operating segments at a glance

All four customer segments enjoyed a positive business performance in the first six months, and improved on or at least maintained their prioryear earnings levels. Both net interest income and net fee and commission income rose in Corporate Customers. This reflects the growth in lending business and the simultaneous intensification of crossselling. Corporate finance solutions and products to hedge interest, commodity and currency risks were particularly sought-after by customers. Financing commission, for example from guarantee business, increased as well. The encouraging trend was confirmed by a survey in Finance magazine, which revealed that LBBW – now ranks second among banks for SMEs – had the strongest positive development among corporate banks. This was offset by the rise in allowances for losses on loans and securities, with the result that the segment’s profit before tax matched the previous year’s level at EUR 160 million (EUR 162 million).

The Real Estate/Project Finance segment maintained its growth trajectory. LBBW generated a new business volume of EUR 4.1 billion in commercial real estate financing while upholding the strict quality and profitability criteria of its portfolio. In project finance business it expanded in infrastructure and renewable energies in particular. The segment’s profit before tax climbed by 14% to EUR 116 million thanks to higher financing income.

In Capital Markets LBBW once again demonstrated its strong position in debt capital markets business– alongside its core business in covered bond products also with new asset classes and mandates from new clients. It also defended its leading role in certificates business, expanding its customer base and its product range. Moreover, Treasury made a key contribution to earnings thanks in part to sales of securities in LCR portfolio management. Overall, despite the challenging market environment the segment achieved a profit before taxes of EUR 90 million in the first half of the year – significantly higher than the previous year’s EUR 51 million.

Private Customers/Savings Banks segment reported a profit before taxes of EUR 12 million after EUR 13 million in the first half of 2018 in spite of a further deterioration in interest levels. Customers again entrusted the Bank with higher deposits while seeking more loans. Moreover, sales initiatives, for instance in real estate brokerage or insurance products, contributed to improved net fee and commission income. In this segment as well, this was counteracted by the trend in interest rates and higher allowances for losses on loans and securities. The cooperation with the savings banks progressed well, with a record new business volume of almost EUR 3 billion in development loan business.

Outlook

LBBW is assuming that the overall conditions will become tougher in the second half of the year owing to low interest rates, the slowing economy and geopolitical tension. Nonetheless, LBBW is still forecasting a consolidated profit before tax for 2019 in the mid three-digit EUR million range and above the prior-year level

Business figures for the LBBW Group as at 30 June 2019

|

01/01/2019 – 30/06/2019 EUR million |

01/01/2018 – 30/06/2018 EUR million |

Change in EUR million | Change in % | |

|---|---|---|---|---|

| Net interest income | 811 | 796 | 15 | 1.9 |

| Net fee and commission income | 279 | 262 | 17 | 6.5 |

| Net gains/losses on remeasurement and disposal | 144 | 135 | 9 | 6.8 |

| of which allowances for losses on loans and securities | – 63 | – 33 | - 30 | 89.9 |

| Other operating income/expenses | 52 | 58 | - 6 | - 9.6 |

| Total operating income/expenses | 1,286 | 1,250 | 36 | 2.9 |

| Administrative expenses | – 864 | – 878 | 14 | – 1.6 |

| Expenses for bank levy and deposit guarantee system | – 102 | – 89 | – 13 | 14.8 |

| Consolidated profit/loss before tax | 319 | 282 | 36 | 12.9 |

| Income taxes | – 100 | – 77 | - 23 | 30.3 |

| Net consolidated profit/loss | 219 | 206 | 13 | 6.4 |

Figures may be subject to rounding differences. Percentages are based on the exact figures.

|

30/06/2019 in EUR billion |

31/06/2018 in EUR billion |

Change in EUR billion | Change in % | |

|---|---|---|---|---|

| Total assets | 265 | 259 | 7 | 2.5 |

| Risk-weighted assets | 82 | 79 | 3 | 3.9 |

|

30/06/2019 in % |

30/06/2018 in % |

|

|---|---|---|

| Common equity Tier 1 capital ratio (CRR/CRD IV „fully loaded“) | 14.6 | 14.9 |

| Total capital ratio (CRR/CRD IV „fully loaded“) | 21.9 | 21.5 |

|

01/01/2019 – 30/06/2019 in % |

01/01/2018 – 30/06/2018 in % |

|

|---|---|---|

| Return on equity (ROE) | 5.0 | 4.4 |

| Cost/income Ratio (CIR) | 71.4 | 75.4 |

| 30/06/2019 | 31/12/2018 |

Change in absolute terms |

Change in % | |

|---|---|---|---|---|

| Employees | 9,908 | 10,017 | – 109 | – 1.1 |