Landesbank Baden-Württemberg (LBBW) maintained its course despite strong headwinds thanks to its customer-oriented business model and generated a net consolidated profit before tax of EUR 477 million, slightly above the previous year's figure (EUR 473 million). "Over the past few years LBBW has gained a very good position to operate successfully on a sustained basis amid a difficult environment. On this basis we are aiming for targeted and risk-conscious growth in our core business areas," said Hans-Jörg Vetter, Chairman of LBBW’s Board of Managing Directors, at the annual press conference in Stuttgart. "Due to the systematic reduction of risks LBBW has the balance sheet scope and the capital strength to support business as a reliable partner," added Vetter. For the current year the Bank expects a moderate rise in net profit before tax.

Slight improvement in net profit before tax to EUR 477 million in 2014 (previous year: EUR 473 million) LBBW has generated a profit in each quarter for three consecutive years Board of Managing Director proposes dividend of EUR 313 million (previous year: EUR 72 million) Systematic continuation of risk reduction, credit substitute business run off almost completed Common equity Tier 1 capital ratio increased to 13.6 percent and total capital ratio to 18.9 percent in accordance with CRR/CRD IV (fully loaded) Moderate increase in net profit before tax expected this year

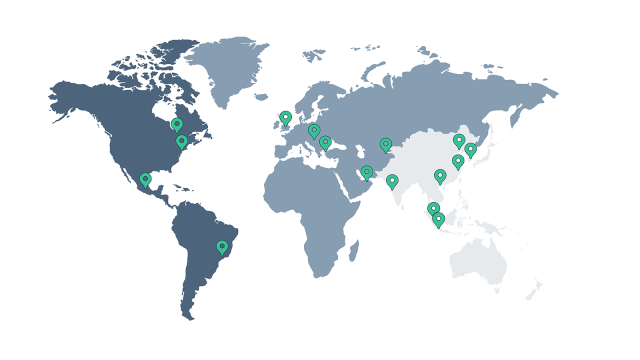

There were no significant changes to the preliminary figures for the 2014 financial year reported in February. Net consolidated profit after tax according to IFRS increased to EUR 434 million (previous year: EUR 339 million). The unappropriated profit according to German Commercial Code (HGB) rose to EUR 313 million, up from EUR 72 million in the previous year when it was necessary to pay previously omitted hybrid capital distributions. The Board of Managing Directors will be proposing to the annual general meeting a dividend equaling the full HGB profit. The agreed repayment of silent partners' contributions to the owners amounting to EUR 1 billion took place already in April 2014, as planned. The risk profile improved further thanks to the continuing reduction of legacy assets. The Bank made particularly rapid progress in credit substitute business, which had comprised EUR 95 billion in 2008. In the past year this portfolio was reduced from EUR 11 billion to EUR 2 billion. An important contribution came from the full sale of the securitization portfolio guaranteed by the owners with a most recent volume of EUR 4.7 billion to international investors in August. Risk weighted assets according to CRR/CRD IV, the EU Directive and Regulation for the implementation of Basel III, also declined again to EUR 82 billion, down from EUR 90 billion at the end of 2013. This led to a further rise in the capital ratios. At the end of last year the common equity Tier 1 capital ratio according to CRR/CRD IV with transitional rules was 14.6 percent. On a fully loaded basis, it came to 13.6 percent. The total capital ratio with transitional rules increased to 19.9 percent; on a fully loaded basis it was 18.9 percent. The leverage ratio as defined in CRR/CRD IV (fully loaded) stood at 4.1 percent at the end of 2014 and thus already exceeded the requirements foreseen by the Basle Committee. Overview of the operating segments The three operating segments showed a divergent performance in the past financial year, but they all contributed to the net consolidated profit. The largest segment, Corporates , increased its net profit before tax substantially to EUR 907 million, up from EUR 742 million in the previous year. While the companies in the core markets raised hardly any additional funds in the first half of the year on account of their good liquidity situation, demand for loans picked up perceptibly in the second half. LBBW was able to establish itself firmly on the market, especially for larger transactions, and was once again among the leading arrangers for syndicated loans in Germany, for example. The rise in net profit was also due to the successful equity investment business. Furthermore, the robust economic situation and high quality of the loan portfolio led to substantially reduced expenses for allowances for losses on loans and advances. Lower income as a result of the targeted reduction of non-core banking activities and risky individual exposures had the opposite effect. The Retail/Savings Banks segment almost matched the previous year's income level despite lower interest rates and intense competition. However, forward-looking capital spending on the transforming of the IT architecture led to an increase in administrative expenses. All told, net profit before tax came to EUR 70 million (previous year: EUR 106 million). Net profit in the Financial Markets segment declined from EUR 322 million to EUR 90 million in the past year. This was due to very muted demand for investment and hedging products against the backdrop of current market conditions with a flat yield curve and low volatility. In addition, non-recurring effects and increased IT costs to comply with new regulatory requirements and reporting duties weighed on the segment result. Expense and income items Net interest income , boosted by a decline in interest expenditure due to lower refinancing costs, rose by EUR 105 million to EUR 1.878 billion. Allowances for losses on loans and advances dropped substantially to EUR 104 million (previous year: EUR 314 million). The reasons for this fall include notably higher reversals on account of upbeat economic conditions. Net fee and commission income recorded a moderate decline of EUR 27 million to EUR 518 million, reflecting the muted demand for loans in the first half of the year. The decrease in net gains/losses from financial instruments measured at fair value through profit or loss to EUR -120 million was attributable to various effects. Among other factors, contributions from narrowing spreads on credit derivatives declined substantially year on year. In addition, pressure was exerted by the valuation of derivatives in the banking book which are in economic hedging relationships but cannot be included in hedge accounting. Furthermore, customer business with hedging products, in particular, showed a muted performance. Net gains/losses from financial investments rose to EUR 263 million, especially thanks to income from the sale and valuation of equity investments. Other operating income/expenses fell slightly to EUR 101 million. New regulatory requirements such as the bank stress test and increasing reporting duties together with the transforming of the IT architecture prompted a 4.5 percent rise in administrative expenses to EUR 1.853 billion. The cost/income ratio came to 77.9 percent. The operating result amounted to EUR 683 million, down from EUR 728 million in the previous year. The decline in the guarantee commission for the risk shield of the State of Baden-Württemberg from EUR 300 million to EUR 191 million is mainly the result of the sale of the guarantee portfolio in August 2014. Net consolidated profit/loss before tax rose marginally to EUR 477 million. Net consolidated profit/loss after tax increased to EUR 434 million, particularly on account of non-recurring effects in deferred and non-periodic taxes. Strategic outlook: Risk-conscious growth and steady efficiency improvements Despite intense competition in the markets, low interest rates and rising regulatory requirements, LBBW sees itself as well-positioned for the future, demonstrated not least by its solid capitalization and robust earnings performance. At the annual press conference Hans-Jörg Vetter, Chairman of the Board of Managing Directors, made it clear that the Bank wants to consolidate and further expand the good market position it has achieved after the successfully completed restructuring. Its focus remains unchanged on the five core business areas of corporates, private customers, savings banks, commercial real estate finance and customer-oriented capital markets business. In corporates business LBBW still aims to establish itself among the top three customer banks in Germany. To this end, it will focus on its proven concept of being close to its region, of advisory excellence and a broad product range and gradually roll it out in other regions. Thus it recently opened its sixth office in North-Rhine Westphalia, in Cologne. Secondly, the Bank is seeking to deepen collaboration with its customers by going beyond traditional loans - with forms of financing such as leasing and factoring or services relating to payment transactions or international business. In commercial real estate finance the Bank also sees good market opportunities with a risk-conscious strategy and is therefore purposefully expanding its distribution network in Germany. In private customer business the Bank is responding to changing customer requirements by honing its profile as a multi-channel bank. Alongside its branches, the Bank is increasingly focusing on electronic distribution channels such as online banking and the video advisory service introduced last year. Moreover, there is further potential in wealth management, which is being purposefully expanded. In the savings bank business LBBW sees itself as the partner of choice thanks to its own experience in corporate and private customer business, supporting the savings banks with taylor-made solutions that meet their needs. Particularly at a time when the savings banks are standardizing their selling and execution processes to an increasing extent on account of the demanding conditions, there is increasing call for such solutions. For example, LBBW is offering the savings banks comprehensive services for the investment and advisory process in their investment business. In capital markets business LBBW continues to focus on customer business. Here, depository business for example is being expanded through the recently agreed takeover of NordLB's depository operations. Against the backdrop of the major changes in regulatory requirements, LBBW is currently reviewing how capital markets business can be tailored to the needs of customers to an even greater extent. At the same time as harnessing its growth potential, LBBW is aiming to improve its efficiency permanently across the Bank. To this end, the internal processes and structures are undergoing continuous review. For example, loan processing will become leaner, faster and less expensive thanks to increased standardization. Furthermore, LBBW is renewing its IT architecture to prepare it for the rising demands from the competition and the regulatory authorities. Outlook for the current year For 2015 LBBW expects historically low interest rates and a stable economic situation in its core markets. In the year to date, the Bank has recorded a stable operating profit basis. Despite the challenging market setting, the Bank expects a further moderate increase in net profit before tax for the current year as a whole in the absence of any exceptional market turbulence, an unforeseen tightening of regulatory or legal provisions or an unexpectedly sharp economic slump.

Business figures for the LBBW Group as at 31 December 2014