LBBW once again served as a joint lead manager for the social bond issued by the European Union as part of its SURE program. The bond has a total volume of EUR 14bn and was issued in two tranches – EUR 10bn with a term of seven years and EUR 4bn with a term of 30 years. LBBW was also a joint lead manager for the third SURE bond issued in November 2020. The other joint lead managers for this new bond are Barclays, Commerzbank, Deutsche Bank and Goldman Sachs.

“We see LBBW’s selection as an issuing bank for the EU’s SURE bond as a major sign of confidence and corroboration of our expertise in the placement of sustainable investments,” said Dr. Christian Ricken, LBBW’s Director of Capital Markets.

The current bond is the fourth transaction under the EU’s SURE social bond program, which is to amount to EUR 100bn in total. It is part of the EU’s efforts to aid the economic recovery after the coronavirus pandemic and its repercussions, and primarily serves to finance EU Member States’ short-time working programs. Approximately EUR 40bn in total was issued in the three previous SURE transactions.

This latest transaction was also met with great interest. The books were closed in just under two hours, with an order volume of more than EUR 132bn. Both tranches were significantly oversubscribed, the seven-year bond more than eight-fold and the 30-year bond by as much as more than 12-fold.

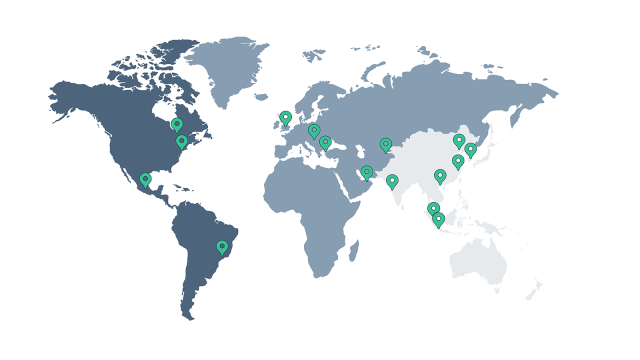

The EUR 10bn tranche of the social bond with a term of seven years was quoted 16 basis points below mid-swap (an inter-bank rate). The largest share of the highly diversified order book went to bank treasuries at approximately 40%, followed by funds at around 35% and central banks at approximately 20%. Most of the investors are from the UK (35%), followed by Germany (14%), the Benelux countries and Italy (both 9%) and France (8%).

The EUR 4bn tranche of the social bond with a term of thirty years was issued five basis points above mid-swap. This tranche was mostly bought up by funds (46%), banks (30%) and insurance/pension funds (11%). The investors were mostly from Germany (33%), the UK (16%), the Benelux countries (13%), Italy (12%) and France (8%).