November 07, 2025

Artificial intelligence and the labor market

Risks for career starters, opportunities for experienced specialists.

To the point!

The world of work is undergoing a profound transformation. Artificial intelligence (AI) is reshaping professions across industries. Standardized and repetitive tasks, such as data processing, logistics, or basic administrative duties, are particularly affected. AI can automate time-intensive processes, potentially leading to a decline in job opportunities for entry-level workers. For recent graduates in fields like law or consulting, the early stages of their careers are often dominated by tasks like coding, research, or preparing presentations and briefs. It is foreseeable that AI will soon perform these activities more cheaply and efficiently.

Seasoned experts are expected to remain in demand, even as AI advances. But these experienced professionals once upon a time started out in junior roles as well. How will individuals climb the career ladder if the bottom rungs are missing?

AI productivity gains are no hallucination

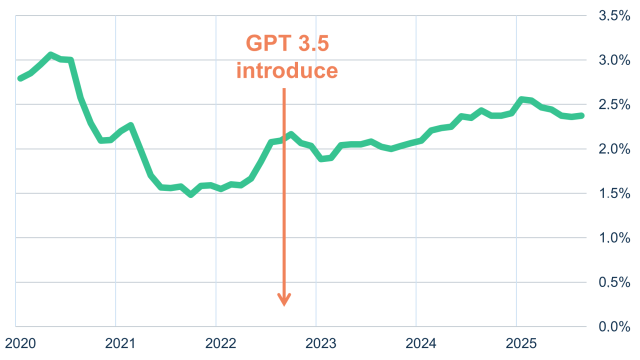

So far, the feared job apocalypse has not materialized. In the United States, where AI adoption is further advanced, the relative unemployment rate among young university graduates has hardly changed (see chart). Perhaps it is still too early to identify sweeping trends. A recent study by Seyed Hosseini and Guy Lichtinger of Harvard University provides a more nuanced perspective. They examined employment patterns for junior and senior employees in U.S. companies, finding that the number of junior staff has recently been declining, while the number of senior employees has continued to grow.

Interestingly, in companies that actively began hiring specialists to integrate AI into their business processes from 2022 onwards junior employee numbers fell almost 8% faster than in companies that did not make such hires. Young professionals are increasingly anxious about their prospects.

In most cases, this decline was due to a reduction in hiring younger employees rather than widespread layoffs. However, this could change: tech companies at the forefront of the AI revolution – such as Amazon and Meta – have recently announced plans to cut tens of thousands of jobs, particularly in administrative roles. Are those layoffs canaries in the coalmine?

Fig.: US unemployment rate

US unemployment rate of 20-24 year-olds with Bachelor Degree, minus overall unemployment rate (12-month mov-ing average)

Hopes and realities of AI adoption

But will the future really be as grim as it sounds? AI skeptics often reference the so-called Solow Paradox, named after growth economist and Nobel laureate Robert Solow, who once quipped that "you can see the computer age everywhere but in the productivity statistics." That's quite a bon mot. However, there are early signs that some large companies are already reaping significant productivity gains thanks to AI. For smaller businesses, these gains are (so far) largely absent.

This spells trouble for Germany. The country's economy is heavily reliant on small and medium-sized enterprises (SMEs), many of which are family-owned. These businesses are typically not early adopters of AI. At the same time, demographic shifts are making the shortage of skilled labor an increasingly urgent problem for Germany. German companies should be embracing new technologies with particular enthusiasm.

Alas, they are not. A survey conducted by the credit agency Creditreform found that only 27% of medium-sized German companies currently use AI technologies, and 17% plan to adopt them in the future. Skepticism dominates, particularly in the SME sector, where over two-thirds of respondents dismiss AI’s role in mitigating worker shortages as negligible or non-existent. Many SMEs are either unwilling or unable to fully adopt AI at this time, often citing such perceived obstacles as lack of expertise, time and resources, or data protection concerns.

This bodes poorly for Germany’s capacity for innovation and economic competitiveness. Adverse demographic trends are broadly given, meaning the shrinking workingage population must be all the more productive if the country hopes to maintain its standard of living. Businesses cannot afford to shy away from technological progress. If widely adopted, AI has the potential to reverse the long-standing decline in German productivity growth . If Germany remains on the sidelines of the AI revolution, economic stagnation may become entrenched – leaving young people with certainly diminished opportunities, even as their numbers decline.

Take courage: embracing progress is the only way forward!

Dr. Moritz Kraemer, Chief Economist / Head of Research at LBBW

Download To the point!

-

268.1 KB | November 07, 2025

This publication is addressed exclusively at recipients in the EU, Switzerland, Liechtenstein and the United Kingdom.

This report is not being distributed by LBBW to any person in the United States and LBBW does not intend to solicit any person in the United States.

LBBW is under the supervision of the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Germany) and the German Federal Financial Supervisory Authority (BaFin), Graurhein-dorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany).

This publication is based on generally available sources which we are not able to verify but which we believe to be reliable. Nevertheless, we assume no liability for the accuracy and completeness of this publication. It conveys our non-binding opinion of the market and the products at the time of the editorial deadline, irrespective of any own holdings in these products. This publication does not replace individual advice. It serves only for informational purposes and should not be seen as an offer or request for a purchase or sale. For additional, more timely in-formation on concrete investment options and for indi-vidual investment advice, please contact your investment advisor.

We retain the right to change the opinions expressed herein at any time and without prior notice. More-over, we retain the right not to update this information or to stop such updates entirely without prior notice.

Past performance, simulations and forecasts shown or described in this publication do not constitute a reliable indicator of future performance.

The acceptance of provided research services by a securities services company can qualify as a benefit in supervisory law terms. In these cases LBBW assumes that the benefit is intended to improve the quality of the relevant service for the customer of the benefit recipient.

Additional Disclaimer for recipients in the United Kingdom:

Authorised and regulated by the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frank-furt/Main (Germany) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). Authorised by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request.

This publication is distributed by LBBW to professional clients and eligible counterparties only and not retail clients. For these purposes, a retail client means a person who is one (or more) of (i) a client as defined in point (7) of Article 2(1) of the UK version of Regulation (EU) 600/2014 which is part of UK law (UK MiFIR) by virtue of the European Union (Withdrawal) Act 2018 (EUWA) who is not a professional client (as defined in point (8) of Article 2(1) of UK MiFIR); or (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 (as amended, the FSMA) and any rules or regulations made under the FSMA (which were relied on immediately before the 31 December 2020 (IP completion day)) to implement Directive (EU) 2016/97 on insurance distribution, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of UK MiFIR; or (iii) not a qualified investor as defined in the UK version of Regulation (EU) 2017/1129 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market, which is part of UK law by virtue of the EUWA (the UK Prospectus Regulation).

This publication has been prepared by LBBW for information purposes only. It reflects LBBW’s views and it does not offer an objective or independent outlook on the matters discussed. The publication and the views expressed herein do not constitute a personal recommendation or investment advice and should not be relied on to make an investment decision. The appropriateness of a particular investment or strategy will depend on an investor’s individual. You should make your own independent evaluation of the relevance and adequacy of the information contained in this publication and make such other investigations as you deem necessary, including obtaining independent financial advice, before partici-pating in any transaction in respect of the financial instruments referred to this publication herein.

Under no circumstance is the information contained within such publication to be used or considered as an offer to sell or a solicitation of an offer to buy any particular investment or security. Neither LBBW nor any of its subsidiary undertakings or affiliates, directors, officers, employees, advisers or agents accepts any responsibility or liability whatsoever for/or makes any representation or warranty, express or implied, as to the truth, fullness, accuracy or completeness of the information in this publication (or whether any information has been omitted from the publication) or any other information relating to the, whether written, oral or in a visual or electronic form, and howsoever transmitted or made available or for any loss howsoever arising from any use of this publication or its contents or otherwise arising in connection therewith.

The information, statements and opinions contained in this publication do not constitute or form part of a public offer. LBBW assumes no responsibility for any fact, recommendation, opinion or advice con-tained in any such publication and expressly disclaims any responsibility for any decisions or for the suitability of any security or transaction based on it. Any decisions that a professional client or eligible counterparty may make to buy, sell or hold a security based on such publication will be entirely their own and not in any way deemed to be endorsed or influenced by or attributed to LBBW.

LBBW does not provide investment, tax or legal advice. Prior to entering into any proposed transaction on the basis of the information contained in this publication, recipients should determine, in consultation with their own investment, legal, tax, regulatory and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences, of the transac-tion.