- Earnings upturn confirms profitable growth in customer business

- Net interest income as well as net fee and commission income up on previous year

- Cost/income ratio declines to 71.8%

- Return on equity improves to 4.6%

- Common equity Tier 1 capital ratio at 14.6% - still far above regulatory requirements

- Total capital ratio strengthened with successful AT-1 bond issue over 750 million euros

- Quality of lending portfolio remains high with marginally higher allowances for losses on loans and advances

- EUR 259 million distribution to owners planned

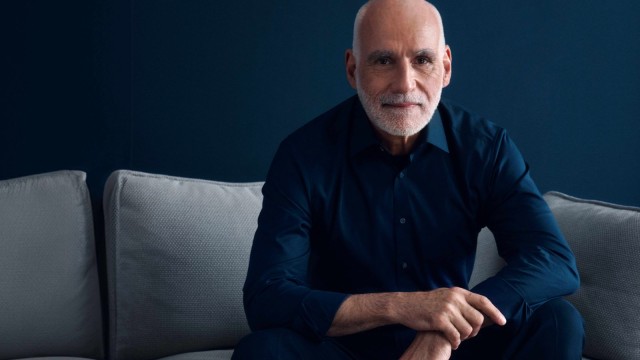

Building on its solid business model as a mittelstands-minded universal bank, LBBW continued to generate profitable growth in the last year and has again considerably improved its result. The Group’s consolidated profit before tax rose by 11.4% to EUR 612 million (2018: EUR 549 million). “We continued our positive development last year and generated a good result. This shows that our strategy is working. LBBW is still on track”, said LBBW’s CEO Rainer Neske.

With regard to the current developments in the markets, Neske says: “The effects of the Corona virus will have a major impact on the German economy as a whole in 2020, and thus also on the banking sector. LBBW is well prepared for this challenge due to the very solid development in recent years, its strong capital base and its conservative risk profile. As a bank, it is now our job to support our customers even in difficult times."

Development in 2019

The most important earnings driver was the successful customer business, which is reflected in a 7.5% increase in net interest income and an 8.7% rise in net fee and commission income. In doing so, LBBW is consistently standing by its conservative risk policy. Despite the weak economic climate, allowances for losses on loans and advances were only slightly higher than in the previous year.

LBBW’s capital base also remains comfortable and well exceeds regulatory capital requirements. The common equity Tier 1 capital ratio (CRR/CRD IV fully loaded) amounted to 14.6% at the end of 2019 (31 December 2018: 15.1%). A EUR 750 million AT-1 bond issued increased the total capital ratio to 22.9% (31 December 2018: 21.9%). Thanks to strict cost discipline combined with higher income, the bank further improved its cost/income ratio from 73.1% to 71.8%. LBBW intends to distribute EUR 259 million to its owners.

Further development along the strategic cornerstones

Three years ago, LBBW adopted a new strategy based on the four strategic cornerstones business focus, digitalization, sustainability and agility, which it has been consistently implementing ever since. It continued to make considerable progress in this area in 2019.

An example of business focus is the Schuldschein business. Here, LBBW’s corporate customers business and its capital markets business successfully work hand in hand. This allows the bank to offer both custom financing solutions for companies and attractive investment opportunities for long-term investors. With a market share of 20%, LBBW again reaffirmed its number one market position and processed 53 Schuldschein transactions with a volume of EUR 12.6 billion last year.

LBBW continued to hone its profile in terms of sustainability last year. Against the backdrop of a rapidly changing environment, its aim is to remain one of Europe’s most sustainable banks in the future while also sensibly balancing the very different expectations of the bank’s stakeholders. LBBW still has with top ratings from leading sustainability rating agencies. In addition, in 2019 it has been one of the founding signatories of the United Nation’s “Principles for Responsible Banking”. On the market for sustainable investments, LBBW has earned itself a leading position in transactions for customers, for example with Porsche AG’s largest green Schuldschein to date (EUR 1 billion). It also placed numerous own green issues, for example multiple large-volume green bonds, the first green mortgage-backed covered bond in USD and its first own social bond. Another example of innovation was the first stepup bonds for private investors with sustainable use of funds. In total, LBBW manages around EUR 23 billion of client funds under sustainability criteria.

LBBW also continued to make progress in the digitalization of customer interfaces and processes last year in order to make banking simpler, more customer-focused and more efficient. The new Corporates portal, for example, provides corporate clients with convenient, web-based access to LBBW’s range of services included a new app, where the whole guarantee process has been digitalized. As a member of the international trade finance network Marco Polo, LBBW is also promoting the digitalization of foreign trade operations. For the first time, a commercial papers transaction was conducted on the basis of blockchain in corporation with its customer MEAG. The financing platform Debtvision, which was established in 2018, also continued to grow. Now it has more than 300 registered investors. Last year, within 33 transactions orders totaling EUR 2.1 billion were made on this platform.

Last but not least, LBBW is also incorporating more and more aspects and working methods from the agility cornerstone into its corporate culture, for example by using agile project methods or employing agility managers and corresponding personnel development measures for employees.

Figures at a glance

Both net interest income and net fee and commission income were higher than in the previous year despite ongoing low interest rates and a high competitive market. This improvement demonstrates the high earnings quality. Net interest income rose by 7.5% to EUR 1,676 million (2018: EUR 1,558 million). This was mainly due to growth in lending business with corporate clients and in real estate and project financing, which also benefited from early loan repayments. LBBW increased its net fee and commission income by 8.7% to EUR 558 million (2018: EUR 513 million). This was driven primarily by higher proceeds in the custody and securities business, especially regarding securities syndicate business for example as part of placing issues. However, fee and commission income also enjoyed an increase in the lending, brokerage and payments business.

Net gains/losses on remeasurement and disposal fell to EUR 169 million. Allowances for losses on loans and advances are an important part of this item. Despite the economic slowdown, these were only slightly higher than in the previous year at EUR 151 million (previous year: EUR 141 million). This shows that LBBW’s lending portfolio is still solid. At 0.6%, the non-performing loan (NPL) ratio was low compared to the industry as a whole. Lower income from sales of securities and measurement effects from derivative transactions continued to play a role in the decline in net gains/losses on remeasurement and disposal.

LBBW continues to have its costs under control. Administrative expenses were only slightly higher than in the previous year at EUR 1,806 million (previous year: EUR 1,773 million). This was among others a result of the first-time consolidation of a subsidiary, which is reflected primarily in increased personnel costs. Moreover other administrative expenses and expenses for buildings rose slightly.

Expenses for the bank levy and deposit guarantee system went up by EUR 13 million to EUR 102 million. In addition to adjustments made by the German Federal Financial Supervisory Authority (BaFin) for calculating the bank levy, this increase was also driven by allocations to the guarantee system of the Sparkassen-Finanzgruppe. Net income/expenses from restructuring came to EUR -31 million on account of various individual measures.

The LBBW Group’s net consolidated profit before tax rose by EUR 63 million to EUR 612 million in the last financial year. After deducting income taxes of EUR 167 million, net consolidated profit came to EUR 444 million (2018: EUR 413 million).

Operating segments at a glance

Again all four customer segments made positive contributions to net consolidated profit/loss in the past year. The Corporate Clients segment achieved growth in a highly competitive market, improving its profit before tax to EUR 303 million (2018: EUR 298 million) despite higher allowances for losses on loans and advances as a result of economic developments, which rose primarily on account of individual cases. The financing volume in business with medium-sized and large companies rose by around two billion to EUR 51 billion. Business activities picked up in the new focus sectors of utilities/energy, pharmaceuticals/healthcare and technology/media/telecommunication. The bank also successfully expanded cross-selling. Corporate finance income rose and the bank maintained its leading market position for Schuldscheine.

The Real Estate/Project Finance segment performed well, with LBBW generating highly profitable, high quality new business in both areas totaling around EUR 10 billion. This caused the financing volume to increase to EUR 27 billion. Renewable energies accounted for approximately 40% of new business in project financing. The segment’s profit before tax improved substantially from EUR 228 million to EUR 351 million. Early loan repayments and net reversals in allowances for losses on loans and advances also had a positive impact here.

In the Capital Markets Business segment profit before tax climbed from EUR 54 million in the previous year to EUR 117 million. LBBW also confirmed its leading position in primary market business and supported customers’ syndicated capital market transactions totaling over EUR 120 billion. The subsidiary LBBW Asset Management boosted its assets under management for customers from EUR 72 billion to around EUR 80 billion. Treasury activities also helped increase earnings.

The Private Customers/Savings Banks segment expanded its business volume last year, in part shored up by growth in private asset management. Both deposits and financing recorded an upturn. The bank also generated higher fee and commission income, for example from securities business and brokerage business. Collaboration with savings banks also proved successful again, with numerous syndicated loans implemented in conjunction with associated partners within the Savings Banks Finance Group. In the development loan business, LBBW handled new business volume of EUR 5.4 billion. Financing from sustainable investments accounted for over 90% of the total portfolio. However, declining margins in the deposit business on the back of low interest rates squeezed net interest income. In addition, administrative expenses increased as a result of investments in modern infrastructure and more personal service in branch sales. Overall, profit before tax declined to EUR 28 million (2018: EUR 38 million).

Outlook

Faced with sustained low interest rates, intense competition and a weak economic climate, which is now also suffering from the impact of the coronavirus, the general conditions for the banking sector are becoming increasingly challenging. In light of this, LBBW expects to see consolidated profit/loss before tax in the current financial year decline year on year but remain in the mid-three-digit million amount range.

Key figures of the LBBW Group as at 31 December 2019

| 1/1-31/12/2019 EUR million | 1/1-31/12/2018* EUR million | Change EUR million | Change in % | |

|---|---|---|---|---|

| Net interest income | 1,676 | 1,558 | 117 | 7.5 |

| Net fee and commission income | 558 | 513 | 45 | 8.7 |

| Net gains/losses on remeasurement and disposal | 169 | 213 | -43 |

-20.3 |

| of which allowances for losses on loans and securities | -151 | -141 | -10 | 7.2 |

| Other operating income/expenses | 148 | 140 | 8 | 5.9 |

| Total operating income/expenses | 2,551 | 2,424 | 127 | 5.2 |

| Administrative expenses | -1,806 | -1,773 | -33 | 1.8 |

| Expenses for bank levy and deposit guarantee system | -102 | -89 | -13 | 14.7 |

| Net income/expenses from restructuring | -31 | -12 | -19 | >100 |

| Consolidated profit/loss before tax | 612 | 549 | 63 | 11.4 |

| Income taxes | -167 | -136 | -32 | 23.3 |

| Net consolidated profit/loss | 444 | 413 | 31 | 7.5 |

Figures may be subject to rounding differences. Percentages are based on the exact figures.

*Restatement of prior year amounts

Key figures

| 31/12/2019 EUR billion | 31/12/2018 EUR billion | Change EUR billion | Change in % | |

|---|---|---|---|---|

| Total assets | 257 | 241 | 15 | 6.4 |

| Risk weighted assets | 80 | 80 | 0 | 0.2 |

Figures may be subject to rounding differences. Percentages are based on the exact figures.

| 31/12/2019 in % | 31/12/2018 in % | |

|---|---|---|

| Common equity Tier 1 capital ratio (CRR/CRD IV fully loaded) | 14.6 | 15.1 |

| Total capital ratio (CRR/CRD IV fully loaded) | 22.9 | 21.9 |

| 1/1/2019 - 31/12/2019 in % | 1/1/2018 - 31/12/2018* in % | |

|---|---|---|

| Return on equity (ROE) | 4.6 | 4.3 |

| Cost/income ratio (CIR) | 71.8 | 73.1 |

* Restatement of prior year amounts.

| 31/12/2019 | 31/12/2018 | Change absolute terms | Change in percent | |

|---|---|---|---|---|

| Employees | 10,005 | 10,017 | -12 | -0.1 |

Segments at a glance

Corporate Clients

| 1/1-31/12/2019 EUR million | 1/1-31/12/2018 EUR million | |

|---|---|---|

| Net interest income | 806 | 789 |

| Net fee and commission income | 177 | 169 |

| Net gains/losses on remeasurement and disposal | -56 | -37 |

| of which allowances for losses on loans and securities | -128 | -88 |

| Other operating income/expenses | 13 | 20 |

| Total operating income/expenses | 941 | 941 |

| Administrative expenses | -608 | -616 |

|

Expenses for bank levy and deposit guarantee system |

-29 | -26 |

| Net income/expenses from restructuring | 0 | 0 |

| Consolidated profit/loss before tax | 303 | 298 |

Real Estate/Project Finance

| 1/1-31/12/2019 EUR million | 1/1-31/12/2018 EUR million | |

|---|---|---|

| Net interest income | 376 | 278 |

| Net fee and commission income | 20 | 15 |

| Net gains/losses on remeasurement and disposal | 26 | -3 |

| of which allowances for losses on loans and securities | 21 | -6 |

| Other operating income/expenses | 98 | 101 |

| Total operating income/expenses | 520 | 391 |

| Administrative expenses | -156 | -150 |

| Expenses for bank levy and deposit guarantee system | -13 | -12 |

| Net income/expenses from restructuring | 0 | 0 |

| Consolidated profit/loss before tax | 351 | 228 |

Capital Markets Business

| 1/1-31/12/2019 EUR million | 1/1-31/12/2018 EUR million | |

|---|---|---|

| Net interest income | 207 | 158 |

| Net fee and commission income | 130 | 117 |

| Net gains/losses on remeasurement and disposal | 279 | 290 |

| of which allowances for losses on loans and securities | 1 | 3 |

| Other operating income/expenses | 8 | 3 |

| Total operating income/expenses | 624 | 569 |

| Administrative expenses | -463 | -456 |

| Expenses for bank levy and deposit guarantee system | -44 | -45 |

| Net income/expenses from restructuring | 0 | -15 |

| Consolidated profit/loss before tax | 117 | 54 |

Private Customers/Savings Banks

| 1/1-31/12/2019 EUR million | 1/1-31/12/2018 EUR million | |

|---|---|---|

| Net interest income | 306 | 316 |

| Net fee and commission income | 244 | 230 |

| Net gains/losses on remeasurement and disposal | 0 | 14 |

| of which allowances for losses on loans and securities | -4 | 6 |

| Other operating income/expenses | 9 | -1 |

| Total operating income/expenses | 558 | 558 |

| Administrative expenses | -527 | -517 |

| Expenses for bank levy and deposit guarantee system | -2 | -4 |

| Net income/expenses from restructuring | -2 | 1 |

| Consolidated profit/loss before tax | 28 | 38 |

Corporate Items/Reconciliation/Consolidation

| 1/1-31/12/2019 EUR million | 1/1-31/12/2018 EUR million | |

|---|---|---|

| Net interest income | -19 | 18 |

| Net fee and commission income | -13 | -18 |

| Net gains/losses on remeasurement and disposal | -80 | -51 |

| of which allowances for losses on loans and securities | -42 | -56 |

| Other operating income/expenses | 20 | 17 |

| Total operating income/expenses | -92 | -34 |

| Administrative expenses | -52 | -34 |

| Expenses for bank levy and deposit guarantee system | -14 | -2 |

| Net income/expenses from restructuring | -29 | 2 |

| Consolidated profit/loss before tax | -186 | -69 |