ING and Landesbank Baden-Württemberg (LBBW) together led the successful completion of a £400m, five-year loan refinancing 110 Bishopsgate in the City of London. LBBW and ING acted as joint bookrunners. ING, LBBW and SMBC also acted as joint mandated lead arrangers with several other banks joining the syndicate as well.

110 Bishopsgate is a 459k square feet prime office tower on a freehold island site. It stands at 755ft tall making it one of the tallest buildings in London’s financial district. The building is at the heart of new developments including Crossrail, London’s newest high-speed railway network, and a hotel and residential complex.

Salesforce, the fourth largest software company in the world, occupy 11 floors with the remainder tenanted to a wide variety of commercial organisations. The building is owned by a consortium of investors including Heron International. This refinancing displays the appetite for City of London office space, the liquidity of the capital markets and the quality of the asset.

Craig Prosser, Head of UK Real Estate, LBBW, said, “110 Bishopsgate is an iconic London building and we are thrilled to have refinanced this property and to continue to support our valued clients.”

Nicholas Lawson, Director, Real Estate Finance, ING, said, “We are delighted to have refinanced 110 Bishopsgate, a high-quality asset and a great testament to the future of office real estate in London’s leading financial centre.”

Patrick Walcher, Global Head of Real Estate, LBBW, said “This financing is further proof of LBBW‘s commitment to the London office market and our continued expertise in providing tailored financing solutions for our clients.”

Mike Shields, Head of Real Estate Finance, EMEA said, “Despite a challenging economic environment and the uncertainty of the WFH impact, this transaction demonstrates the value of our long-standing client relationships and expertise in financing landmark office properties.”

Robert Carney, Head of EMEA Real Estate Finance at SMBC Bank International plc, stated: “SMBC is very pleased to have had the opportunity to act as a joint mandated lead arranger on the 110 Bishopsgate refinancing alongside ING and LBBW. The transaction demonstrates the depth of financing available for top quality London office properties managed by highly experienced sponsors.”

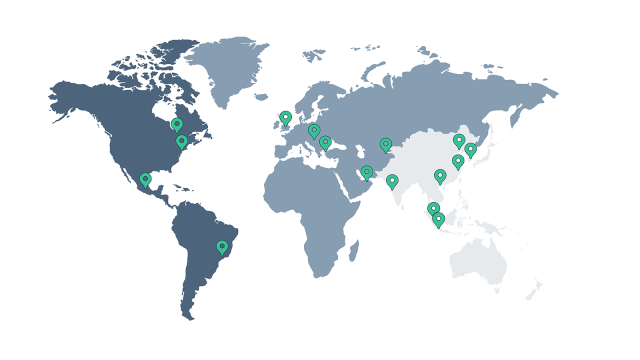

110 Bishopsgate was originally financed in 2016 by ING and LBBW and subsequently syndicated to a number of mostly Asian banks.

For the 2021 refinance which Relationship Directors Nicholas Lawson at ING and Mike Clements at LBBW coordinated. The bank consortium was legally advised by Baker McKenzie, CMS acted as the borrower’s legal counsel and Capital Real Estate were advisors to the non-Heron investors. Savills and CBRE’s are the building joint letting agents (http://salesforce-tower.com/).