May 2024

Green bonds for a better climate

Green bonds are becoming increasingly interesting for financing. This is because investor demand is greater than supply.

As intermediaries between investors and capital seekers, banks play an important role in climate protection. With their help, more capital can flow into sustainable and "green" investments. The means of choice are green bonds. They have been around since 2007 and their volume has multiplied in recent years. In 2020 alone, 224 billion euros in new green bonds were issued worldwide. Despite this, the ever-increasing demand cannot even begin to be met.

What is a green bond?

Green bonds are bonds that invest in sustainable and climate-friendly projects, i.e. belong to the area of green finance. Issuers of green bonds must prove that the money is used in an environmentally friendly way and that the bond helps in the fight against climate change. The spectrum here is very broad. Whether it is renewable energies or electromobility, energy efficiency or the reduced consumption of resources - all of these are considered "green" and sustainable. Those who reduce transportation costs, avoid waste or build energy-saving houses (or renovate them accordingly) can also offer green bonds. Issuers can use these and many other measures as assets to upgrade bond issues as green bonds.

What are the principles of green bonds?

What applies to companies applies even more to governments and banks that use green bonds for refinancing. Binding standards for green bonds do not yet exist, but there is a voluntary guideline, the Green Bond Principles of the International Capital Market Association (ICMA). It specifies what the proceeds may be used for and what the reporting requirements are. The standards of the ICMA guideline also include having an independent agency review the project before it can be labeled as "green". The agency certifies the projects as "sustainable" and thus confirms that the investments actually benefit the environment. With the EU Green Bond Standard, further voluntary principles were defined in November 2023 that are based on the requirements of the EU taxonomy.

Apart from the sustainability rating, green bonds are comparable to conventional bonds in terms of their features and structure. When companies place a bond, the volume is usually at least 500 million euros. If states, federal states, central or other banks are involved, the billion euro limit is quickly exceeded. In the case of the energy company innogy, this involved 850 million euros. Previously, innogy had imposed a set of rules on itself that stipulated how the money from the green bond could be invested: only investments in renewable energies, energy efficiency and electromobility were permitted. The rating agency Sustainalytics reviewed innogy's internal rules and regulations, then compared the bond with the ICMA Green Bond Principles and finally certified it. The result: the bond, in which LBBW also participated, was almost five times oversubscribed.

Who issues green bonds?

Anyone who issues a green bond must transparently disclose that they are investing in green projects. Issuers can be companies, banks or governments. The advantage for them: Issuers thus take account of their own sustainability strategy. The first green bonds were issued by the World Bank in 2000, and since then the market has grown steadily and the issue volume has multiplied.

Green finance is growing rapidly

Experts expect sustainable finance products such as green bonds to continue to develop at a rapid pace. LBBW also sees a megatrend. Investors are increasingly switching from conventional to "green" investments. Issuers who want to take advantage of this trend should carefully analyze which opportunities they can already use for "green" issues or create in the future. "A number of conventional issues could probably already be structured 'green' today if the issuer's framework conditions were analyzed in this direction," says Christoph Zender, who manages bond issues for corporate customers at LBBW.

The demand for green bonds already far exceeds the supply. This is also demonstrated by the response to the largest green bond ever issued in Germany. The bond, which the state-owned development bank KfW launched on the market in May 2019, is worth 3 billion euros - it was three times oversubscribed. KfW primarily uses green bonds to refinance loans for solar and wind parks.

What green bonds does LBBW offer?

LBBW had already placed its first green bond with a volume of EUR 750 million in 2017 - also significantly oversubscribed - to refinance energy-efficient commercial real estate.

In 2018, LBBW followed up on this with a green bond in the form of a EUR 500 million mortgage Pfandbrief. This was followed in 2019 and 2020 by four further issues with a total volume equivalent to over EUR 2.5 billion.?

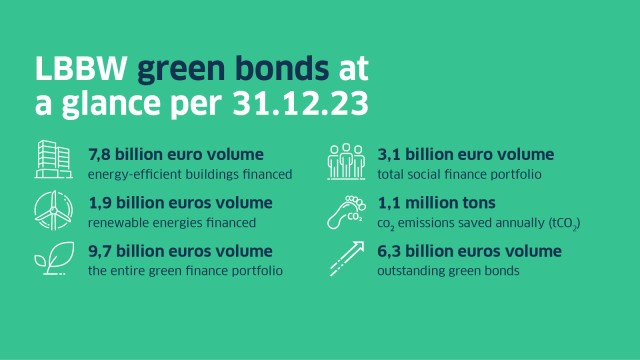

As of December 31, 2023, LBBW has outstanding green bonds with a total volume of EUR 6.3 billion, making it one of the largest green bond issuers worldwide. The proceeds from LBBW's green bonds flow exclusively into projects for renewable energies or energy-efficient buildings. LBBW reports on its green financing portfolio and its positive impact on the climate in the annual Green Bond Allocation & Impact Reporting .

LBBW, already the market leader for covered bonds in Europe, is now also a sought-after address for green bonds. It utilizes a global network of investors interested in green bonds and is in contact with all relevant institutional investors on an almost daily basis. This enables LBBW to place even large volumes quickly for its issuers. Already a leader in marketing, LBBW has long since extended its expertise to the structuring of green bonds. This enables LBBW to offer all the important steps involved in issuing this "green" product from a single source.

Do you have questions?

Contact us!

Marcus Offenhuber