May 16, 2025

Climate policy must remain a priority

The new German coalition lacks vision and drive in climate policy.

On Wednesday, the German Chancellor Friedrich Merz delivered his first government statement. In many respects, it was an impressive speech that radiated confidence. Particularly noteworthy were the firm commitments to deeper European integration and unwavering support ("without any ifs or buts") for Ukrainians, who are bravely fighting for our shared values and freedom. Merz made it clear that Germany is not a "neutral third party" in this conflict and rightly pointed out the multidimensional aggression from Putin's Russia – from cyberattacks to espionage to targeted disinformation – with the intention of undermining societal cohesion.

Merz hits the nail on the head with his security policy

Merz also struck the right chords in his economic policy statements. The notion that Germany will once again become the "growth locomotive" that the world "looks upon with admiration" seems firmly anchored in the realm of wishful thinking, given the numerous growth impediments documented by LBBW Research . Nevertheless, overall, it was a strong speech.

Failure in the new German climate policy

However, on one topic, climate policy, the Chancellor, who belongs to the conservative CDU party, fell short of the already low expectations. To make it clear once again: it's not about protecting the climate. It's about protecting people who are exposed to the climate. Because the climate doesn't care how hot or cold it is, and whether there are droughts or floods.

Climate as a marginal issue in the government statement

In his approximately one-hour speech, the Chancellor dedicated just one minute to climate protection. He spoke vaguely of "new paths" and "non-ideological" and "technology-open" policies. What lies behind these platitudes remained unclear. Instead of advancing the expansion of renewable energies, the new German government is speculating on CO 2 storage. It seemed Merz was primarily focused on lowering energy prices in the climate and energy topic. The fact that effective climate and energy policy also reduces the security risks to which Merz rightly devoted so much space in his speech seems not to have been internalized by the government coalition of the conservative parties CDU and CSU and the social democratic SPD, despite the experience of the gas shock following Russia's attack.

But even in another pet topic of the Chancellor, namely migration, effective climate policy can play a supportive role. Few regions of the world are expected to be as severely affected by droughts and water shortages as North Africa and the Middle East. When livelihoods collapse there due to climate change, where will the local population migrate to?

Fig. 1: Average annual temperature Germany (°C)

Some like it hot? Welcome to Europe!

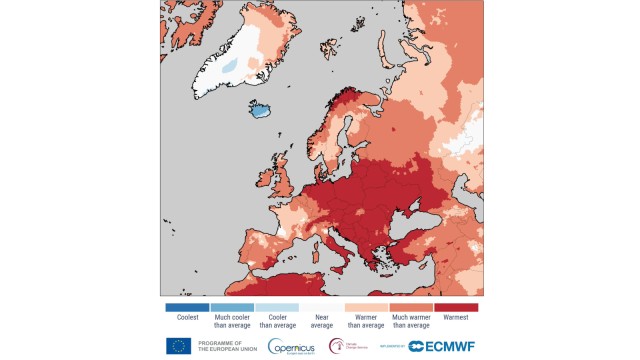

Once again, this year the weather phenomenon of the Ice Saints failed to show up – did Mamertus, Cold Sophie, and their pals perhaps fail to appear due to newly tightened border controls in Germany? In the first quarter, the average temperature in Germany was about two degrees higher than the long-term average, accompanied by a persistent lack of precipitation. Eight of the ten hottest years ever recorded occurred in the past decade. 2024 was the hottest year of all time in Germany and Europe, yet again (see figures). Extreme weather events are rapidly increasing due to the changing climate – even in Germany.

Fig. 2: Temperature deviations from the long-term average

2024 was the hottest year of all time in Germany and Europe.

Source: Copernicus/EU

This is not ideology. This is science. Germany must adjust its climate policy because the economic costs of climate change will continuously rise. If it indeed comes to that, Merz will have to kiss his economic miracle goodbye.

Germany must adjust its climate policy because the economic costs of climate change will continuously rise.

Download To the point!

-

485.0 KB | May 16, 2025

This publication is addressed exclusively at recipients in the EU, Switzerland, Liechtenstein and the United Kingdom. This report is not being distributed by LBBW to any person in the United States and LBBW does not intend to solicit any person in the United States. LBBW is under the supervision of the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Ger many) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Ger many) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). This publication is based on generally available sources which we are not able to verify but which we believe to be reliable. Nevertheless, we assume no liability for the accuracy and completeness of this publication. It conveys our non-binding opinion of the market and the products at the time of the editorial deadline, irrespective of any own holdings in these products. This publication does not replace individual advice. It serves only for informational purposes and should not be seen as an offer or request for a purchase or sale. For additional, more timely in-formation on concrete investment options and for individual investment advice, please contact your investment advisor. We retain the right to change the opinions expressed herein at any time and without prior notice. Moreover, we retain the right not to update this information or to stop such updates entirely without prior notice. Past performance, simulations and forecasts shown or described in this publication do not constitute a reliable indicator of future performance. The acceptance of provided research services by a securities services company can qualify as a benefit in supervisory law terms. In these cases LBBW assumes that the benefit is intended to improve the quality of the relevant service for the customer of the benefit recipient. Additional Disclaimer for recipients in the United Kingdom: Authorised and regulated by the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Germany) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). Deemed authorised by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.