January 23, 2026

The long goodbye

How threatening is the exodus of German citizens, really?

To the point!

Germany urgently needs a better understanding of why people leave the country – and often don’t return.

Disenchantment with politics in Germany is increasingly accompanied by vows – or threats – to leave. The wealthy, in particular, have taken to declaring in public that they could, or would, turn their backs on Germany. Nothing works there anymore, they say, and the reform logjam has not eased since the change of government last May. Recently, “pop titan” Dieter Bohlen – seen for several years as a swaggering judge on Germany’s Pop Idol – hinted he might move to Switzerland or Dubai “if everything here is rubbish.” He fears for his wealth and refuses to accept higher taxes. Whatever one thinks of the political instincts of Modern Talking’s former co-singer, this threat to say goodbye sounds to me like a win-win Germany shouldn’t pass up.

What the numbers show

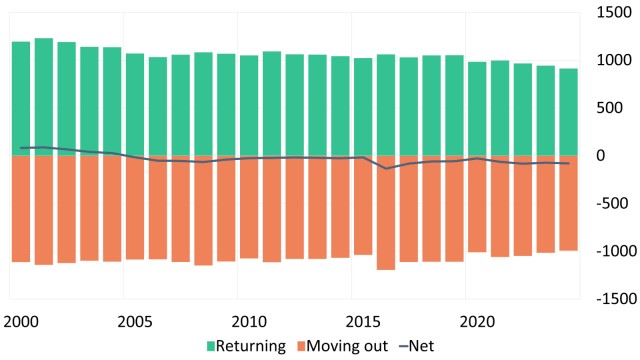

But this isn’t just about yellow-press heroes like Dieter Bohlen. There are actually serious questions at stake. Is there really a brain drain from Germany? Are the pledges to decamp and relo-cate cheap clap trap, or is the emigration of qualified citizens indeed further eroding Germany’s already strained economic prospects? In fact, Germany has been a country of net emigration for two decades already: every year, more German citizens leave than return. Over the past two decades, Germany has thus lost a net total of about one million citizens. In 2024, net emigration stood at 81,000 – the third-highest figure on record. And that came even though, for the first time in this millennium, that year fewer than one million people with German passports left the country.

Fig. 1: Migration of German citizens

(in thousand persons, 2000-2024)

A glance at figure 1 makes clear that while close to one million Germans head abroad each year, an almost equally large num-ber comes back. International mobility, of course, is a good thing in principle – and economically, too. I like to believe that, having myself once been an emigrant and a returnee, I had not only broadened my horizons and deepened my understanding of other cultures but also increased my productivity. I let you be the judge on that one.

It’s the young who leave

The real problem would be if citizens of working age (which strictly speaking no longer applies to the 71-year-old Bohlen) were to depart. That would exacerbate the shortage of skilled labor, which is set to intensify anyway in the coming years for demographic reasons. By contrast, if mainly retirees were to decamp to sunnier climes, the economic impact would be comparatively benign.

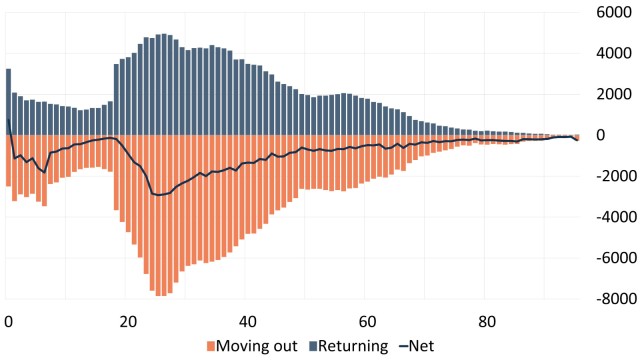

Unfortunately, figure 2 shows that emigration is especially prevalent among the young. The highest occurrence is among those aged 20 to 29, likely including many students. But even among 30- to 50-year-olds, far more leave than return as well. So, it isn’t just the Dieter Bohlens of the country, who Germany can well manage without – it’s precisely the people the country would badly need. According to a 2019 survey, three-quarters of emigrants hold a university degree – usually earned in Germany and funded by German taxpayers. Most departures are job-related: in their destination countries, those who leave earn, on average, €1,200 more per month.

Fig. 2: Migration of German citizens by age

(2024)

With the baby-boomer cohort about to retire in large numbers, it is more urgent than ever for Germany to stem the exodus. Shifting more of the costs of the public pension system onto the younger generation – as happened last month with the Bundestag’s passage of the latest retirement package – was hardly a helpful idea and not exactly seducing the young to stay put. Germany urgently needs a better understanding of why people leave the country – and often don’t return. Only then can policymakers and business take effective countermeasures.

Fig. 3: Foreign Direct Investment of German Companies

(2000-2024, €bn)

⬤ {series.name}: {point.y}

Are companies leaving, too? Yes, but…

It isn’t only citizens who are moving away or threatening to do so. Companies, too, complain about conditions in Germany as a business location and flirt with relocating abroad. Last year, the news caused a stir that Stihl, the Swabian world market leader in chainsaws, planned to move parts of its production overseas – of all places, to high-wage Switzerland. Stihl has since backed away. The flirtation with Switzerland, the company now says, was meant as a wake-up call.

German firms are indeed investing heavily abroad, though the trend is very uneven (see figure 3). To paraphrase Mark Twain: reports of the death of Germany Inc. have been greatly exaggerated. But a pronounced case of wanderlust is plainly diagnosable. We should take it seriously – and treat it.

Dr. Moritz Kraemer, Chief Economist / Head of Research at LBBW

Download To the point!

-

283.7 KB | January 23, 2026

This publication is addressed exclusively at recipients in the EU, Switzerland, Liechtenstein and the United Kingdom.

This report is not being distributed by LBBW to any person in the United States and LBBW does not intend to solicit any person in the United States.

LBBW is under the supervision of the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frankfurt/Main (Germany) and the German Federal Financial Supervisory Authority (BaFin), Graurhein-dorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany).

This publication is based on generally available sources which we are not able to verify but which we believe to be reliable. Nevertheless, we assume no liability for the accuracy and completeness of this publication. It conveys our non-binding opinion of the market and the products at the time of the editorial deadline, irrespective of any own holdings in these products. This publication does not replace individual advice. It serves only for informational purposes and should not be seen as an offer or request for a purchase or sale. For additional, more timely in-formation on concrete investment options and for indi-vidual investment advice, please contact your investment advisor.

We retain the right to change the opinions expressed herein at any time and without prior notice. More-over, we retain the right not to update this information or to stop such updates entirely without prior notice.

Past performance, simulations and forecasts shown or described in this publication do not constitute a reliable indicator of future performance.

The acceptance of provided research services by a securities services company can qualify as a benefit in supervisory law terms. In these cases LBBW assumes that the benefit is intended to improve the quality of the relevant service for the customer of the benefit recipient.

Additional Disclaimer for recipients in the United Kingdom:

Authorised and regulated by the European Central Bank (ECB), Sonnemannstraße 22, 60314 Frank-furt/Main (Germany) and the German Federal Financial Supervisory Authority (BaFin), Graurheindorfer Str. 108, 53117 Bonn (Germany) / Marie-Curie-Str. 24-28, 60439 Frankfurt/Main (Germany). Authorised by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request.

This publication is distributed by LBBW to professional clients and eligible counterparties only and not retail clients. For these purposes, a retail client means a person who is one (or more) of (i) a client as defined in point (7) of Article 2(1) of the UK version of Regulation (EU) 600/2014 which is part of UK law (UK MiFIR) by virtue of the European Union (Withdrawal) Act 2018 (EUWA) who is not a professional client (as defined in point (8) of Article 2(1) of UK MiFIR); or (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 (as amended, the FSMA) and any rules or regulations made under the FSMA (which were relied on immediately before the 31 December 2020 (IP completion day)) to implement Directive (EU) 2016/97 on insurance distribution, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of UK MiFIR; or (iii) not a qualified investor as defined in the UK version of Regulation (EU) 2017/1129 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market, which is part of UK law by virtue of the EUWA (the UK Prospectus Regulation).

This publication has been prepared by LBBW for information purposes only. It reflects LBBW’s views and it does not offer an objective or independent outlook on the matters discussed. The publication and the views expressed herein do not constitute a personal recommendation or investment advice and should not be relied on to make an investment decision. The appropriateness of a particular investment or strategy will depend on an investor’s individual. You should make your own independent evaluation of the relevance and adequacy of the information contained in this publication and make such other investigations as you deem necessary, including obtaining independent financial advice, before partici-pating in any transaction in respect of the financial instruments referred to this publication herein.

Under no circumstance is the information contained within such publication to be used or considered as an offer to sell or a solicitation of an offer to buy any particular investment or security. Neither LBBW nor any of its subsidiary undertakings or affiliates, directors, officers, employees, advisers or agents accepts any responsibility or liability whatsoever for/or makes any representation or warranty, express or implied, as to the truth, fullness, accuracy or completeness of the information in this publication (or whether any information has been omitted from the publication) or any other information relating to the, whether written, oral or in a visual or electronic form, and howsoever transmitted or made available or for any loss howsoever arising from any use of this publication or its contents or otherwise arising in connection therewith.

The information, statements and opinions contained in this publication do not constitute or form part of a public offer. LBBW assumes no responsibility for any fact, recommendation, opinion or advice con-tained in any such publication and expressly disclaims any responsibility for any decisions or for the suitability of any security or transaction based on it. Any decisions that a professional client or eligible counterparty may make to buy, sell or hold a security based on such publication will be entirely their own and not in any way deemed to be endorsed or influenced by or attributed to LBBW.

LBBW does not provide investment, tax or legal advice. Prior to entering into any proposed transaction on the basis of the information contained in this publication, recipients should determine, in consultation with their own investment, legal, tax, regulatory and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences, of the transac-tion.