The German economy is humming along because the quality of items made in Germany is in demand the world over. The export ratio of German companies hits new records year after year. In 2020, the nation exported EUR 1,204.7bn worth of goods, while its imports amounted to EUR 1,025.6bn. Yet, what Germany’s Federal Statistical Office calculates in euros was not necessarily paid in euros.

Even though the euro’s international significance is rising, Germany companies settle nearly half of their foreign transactions in dollars, yen, renminbi, pounds, or exotic currencies. That exposes them to the risk of fluctuating exchange rates. Small and medium-sized enterprises in particular often underestimate that risk, says Stefan Tiemann, Director of the Interest Rate, Currencies, and Commodities Management Solutions (ZWRM) unit at LBBW.

Reasons to do business in a foreign currency

Even though it is easier for German companies to bill transactions in euros, there are convincing reasons not to. They may have a wide variety of arguments.

- Certain transactions are always concluded in the same currency, for example commodities in US dollars (gold, oil, etc.).

- Partners may agree on common currency in order to facilitate settlement for both parties or because the partner with the stronger negotiating position wants it that way.

- Many foreign companies are unable to bill in euros because of their country’s foreign exchange regulations, or they do not have access to the German market for other reasons.

- Billing in a foreign currency is a sign of trust and improves one’s position during price negotiations. For instance, billing in renminbi can have significant pricing advantages for the involved business partners.

- Billing in the currency used by the contract partner can provide a competitive advantage over other Germany or international suppliers, thereby supporting the company’s own acquisition in country.

Exchange rate fluctuations pose a risk of loss

Purchase prices are generally not due until the goods have been delivered. A company selling a machine for 100,000 British pounds (GBP) to a customer in the UK today cannot be certain at what exchange rate it will receive payment upon delivery six months from today. The GBP exchange rate was fluctuating heavily even before Brexit. For instance, the British currency has lost around 30% of its value against the euro in the past two decades. That trend was not consistent, however.

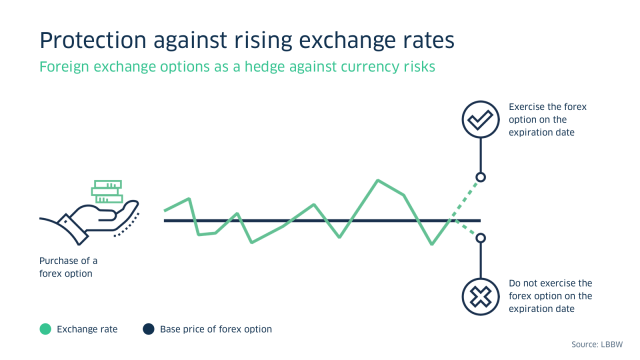

Even minor exchange rate spikes can result in the payment received being several thousand euros less than planned. Thanks to LBBW hedging options, that can be avoided.

Forecasts regarding future exchange rates are often made “too casually,” asserts Stefan Tiemann. “The so-called budget rate that companies assume an exchange rate trend will follow frequently does not correspond to reality.” If the rate deviates considerably, companies can lose money. “There is no need for that. There is a way to manage forex risk.”

Customized currency risk strategy

To manage currency risks, the experts at LBBW offer their corporate customers customized strategies. Those solutions begin with a comprehensive financial advisory session and risk analysis. “We study the company’s key performance indicators, or KPIs, in depth,” LBBW expert Tiemann explains. “As we do, we concentrate solely on the indicators pertaining to currency risk in order to avoid bogging down the entire process and keep the effort and expense for the customer within reasonable limits.” Afterwards, LBBW makes a recommendation for the ideal hedging ratio using easy-to-understand steps. If the customer desires, LBBW and its derivatives specialists will assemble a suitable toolkit.

The purpose of the risk analysis is to answer these key questions:

- How high is the maximum potential loss from the foreign exchange transactions?

- How much risk of loss can the company tolerate? How much does it wish to tolerate?

- How effectively should the risk be hedged so the company does not suffer any critical impact to its KPIs?

- How effectively does hedging mitigate the risk of loss, for example, in terms of return on equity?

To find the right answers, the experts at LBBW simulate possible developments for every specific risk position using historic exchange rates as well as forecasts. At the same time, they calculate how probably those deviations are and how dangerous they may be to the customer’s KPIs. Based on those results, they compute how high the hedge ratio needs to be. LBBW expert Stefan Tiemann says, “Our experience shows that a customized hedging strategy enables customers to significantly lower their forex risk.”

Are you interested in currency hedging or a comprehensive risk analysis?

Feel free to contact us!

Stefan Tiemann

Stefan Tiemann is in charge of the global Interest Rate, Currencies, and Commodities Management Solutions (ZWRM) unit as well as Corporate Customer Liquidity and Investment Management.