LBBW: From the public to policymakers, everyone’s talking about sustainability. As a bank, what’s our current position?

Cara Schulze: Over the past year, the topic of sustainability has been gathering momentum quite strongly on various levels. First, there’s the regulatory aspect. Development here has been extremely dynamic, mainly because of the EU’s ambitious action plan with its demanding timescale. This will see climate targets toughened up significantly by 2030, the ultimate aim being to make Europe the first climate-neutral continent by 2050. In addition to these regulations, last April’s ruling by Germany’s Federal Constitutional Court was a further milestone. Put briefly, the Court held that the Climate Change Act of 2019 is unconstitutional in some parts – because it doesn’t go far enough in terms of climate protection.

How Europe can become climate-neutral by 2050

The EU’s CO2 emissions in billions of tonnes – and the targets for 2050

⬤ {series.name}: {point.y}

LBBW: What concrete requirements are these developments placing on companies?

Schulze: The implementation cost should not be underestimated. Because of the relevant provisions, companies will frequently have to invest in new technologies, services and business models. Larger companies in particular will from now on be under much stricter obligations as regards sustainability. Their reporting obligations, for example, will be much more stringent. In April, the EU Commission published its proposed changes to CSR guidelines. Under these, companies could be obliged to submit comprehensive sustainability reports as early as 2023. The aim is clear: greater transparency in respect of sustainability.

LBBW: Will these changes only affect large companies?

Schulze: No, they’ll also affect suppliers – who are often small or medium-sized enterprises. That’s because, to help with their CSR reports, a growing number of large companies seek information from their suppliers about their delivery sites. Should any shortcomings emerge as regards sustainability, the suppliers have to remedy them – or, in extreme cases, lose the work. So for anyone who wants to maintain a presence in the market, sustainability is unavoidable. Another important example that impacts a lot of companies is the EU Taxonomy Regulation. This will establish a system for classifying environmentally sustainable economic activities, the aim being to create a common EU-wide understanding of the concept of sustainability. Companies will therefore have to make sure from now on that their non-financial reporting makes clear how, and to what extent, their activities are environmentally sustainable.

The 6 objectives of the EU taxonomy

Climate protection

Adapting to climate change

Sustainable use of water resources

Transition to a circular economy

Avoidance of pollution

Protection of ecosystems and biodiversity

LBBW: The EU taxonomy certainly also affects the banking sector

Schulze: Correct: by extension, banks like LBBW are also affected by the EU taxonomy. The EBA, the supervisory body for European banks, aims to introduce the so-called green asset ratio – that is, the ratio of sustainable to non-sustainable assets – as the key indicator of sustainability in banks. We depend on customer data to calculate the green asset ratio, and retrieving this data and integrating it into our data management is a challenging process.

Climate protection is often rather associated with the automotive industry or the energy sector – because these are obvious sources of emissions. But in fact banks also occupy a key position because they’re the ones distributing the money.

LBBW: So the financial sector plays an important role when it comes to sustainability.

Schulze: According to the EU’s action plan, the financial sector actually plays a key role in respect of sustainable growth and climate neutrality. The emphasis here is on three core objectives: redirecting capital flows into sustainable investments, integrating sustainability into risk management and promoting transparency in and a long-term approach to financial and economic activities. Sustainability has also been a part of risk assessment for a long time, as can be seen from publications over the past two years from Germany’s Federal Financial Supervisory Authority (BaFin), the ECB and the EBA. Banks need to work with industry to address this challenge. That’s the way to ensure a more sustainable long-term future for the economy.

LBBW: Where does LBBW stand on sustainability?

Schulze: Our latest sustainability reportshows we’re on the right track with the strategy we’ve adopted. But there’s still plenty to do. Going forward, we’d like to integrate sustainability issues such as climate risks and CO₂ emissions into our risk management activities. We're also aiming to offer companies even more support in implementing and complying with regulatory requirements.

LBBW: What will that mean in concrete terms?

Schulze: If our customers want to invest, the very first requirement is financing for the investment. Our task is therefore to provide the impetus for sustainable projects. According to the European Commission, at least a further 260 billion euros will need to be invested annually in order to reach the climate targets. We want to do our bit to help close this investment gap. Our range of sustainable financing products already covers a broad spectrum – but of course we intend to keep evolving with fresh offers such as the climate-neutral leasing option from LBBW subsidiary SüdLeasing. This allows customers to offset any CO2 emissions from leased assets. LBBW has also, along with 15 other banks in Germany, has made a commitment to start quantifying and publishing the amount of greenhouse gases co-financed by us – the aim here being, of course, to reduce such emissions incrementally. We believe these are all essential steps towards a climate-neutral future.

LBBW: As regards the future, in which direction do you see the sustainable finance market developing?

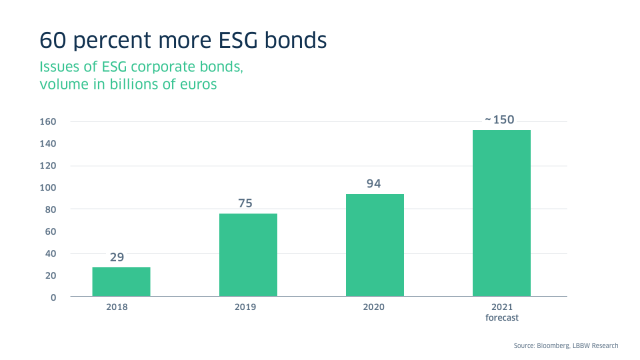

Schulze:In that respect, I’d like to refer you to a study by our analysts at LBBW Research: in March last year, they significantly raised their forecast for 2021 in respect of the market in sustainable corporate bonds – so-called ESG bonds (ESG = environment, social and governance). During the current year, LBBW Research anticipates first issues totalling 150 billion euros, an increase of 60 per cent compared to the previous year and an unprecedented growth rate for sustainable bonds. Here, it is important to note that sustainability always takes environmental, social and economic factors into account. The social element in particular has been brought more sharply into focus during the coronavirus pandemic. This is also evident on the capital market: among sustainable corporate bonds, environmentally oriented green bonds remain dominant, accounting for 80 per cent. But social bonds are becoming more and more important too, with a sevenfold increase in market share over the past two years. Incidentally, LBBW is the front runner in the sustainable finance market: in 2020 we issued eleven green bonds and three social bonds for our customers, with a total value of 22.5 billion euros – making us the number one universal bank as regards green corporate and bank financing

E = environment

An assessment of how a company or sector deals with the earth’s natural resources and of the measures it has introduced to protect the ecosystem and the climate – reducing emissions, for example.

S = social

An assessment of the extent to which business activities are conducted in accordance with human rights and of whether a company is complying with the usual safety and social standards – making sure there are no grievances relating to production and working conditions, for example.

G = governance

An assessment of whether communication from the company management is transparent and complete and whether, for example, structural issues of equitability are clearly defined in accordance with behavioural and remuneration guidelines.

LBBW: And what is the situation as regards ESG-linked financing?

Schulze: For the German market, in which small and medium-sized businesses are so vital, I can actually see considerable potential for further growth in this area. Here, classic forms of financing are connected to the development of sustainability at the company. So ESG-linked financing offers greater flexibility and can also be adapted to suit the specific value driver.

LBBW: Will sustainable financing instruments become the norm?

Schulze: If this development continues at the current speed, ESG financing instruments could well become the new standard within the next three to five years.

A consistent sustainability strategy is a basic requirement for long-term economic success.

LBBW: To summarise, what does sustainability mean to LBBW?

Schulze: Sustainability has been one of our four main strategic focuses, and as such part of our DNA, since 2017. It has proved a success, too, as shown in the major FINANCE study in 2021. Here, corporate customers rated LBBW as Germany’s best bank in the field of sustainability/ESG. We spend a large part of each day talking to our customers and partners, and we notice again and again just how varied their understanding of sustainability is.

Some firms have been addressing the issue for years, while others still need a lot of advice in strategic deliberations on their business model or on selecting specific sustainable forms of financing. But there’s one thing we’re certain of: in the future, companies doing business in accordance with the principles of sustainability will be more successful than those who fail to give this issue the attention it requires. Sustainability gives companies greater resilience, leaving them better equipped to weather crises. As a bank, we’re in a position to help customers from many sectors resolve the apparent contradiction between environmental requirements and commercial success – because the transition has already begun. Now we have to work together to tackle the issue, achieve the set climate targets and secure our basic needs in the long term.